Instead of fixed deposits, retirees can now pick mutual fund schemes

Mutual fund market is a pool of savings contributed by multiple investors. Investment in this fund can be done in various asset classes like equity, debt and liquid assets.

Key Highlights:

- Debt mutual funds provide more returns than FDs.

- Interest earned on Fixed Deposits have higher tax slab

- FDs provide lower returns compared to various mutual fund schemes.

Retirees investors largely consists of senior citizens who always explore investment opportunities from where they can earn extra income and use it for various purposes.

Whenever they want to save a money for a purpose, their first stop would be in fixed deposits, which is the most traditional practice followed in India and among senior citizens. This pool is like their best friend when it comes to investment.

Reason behind investing in FDs for retirees is also valid considering the scheme offers a guaranteed interest along with capital protection. It also comes with an assurance that your hard-earned money is not going anywhere.

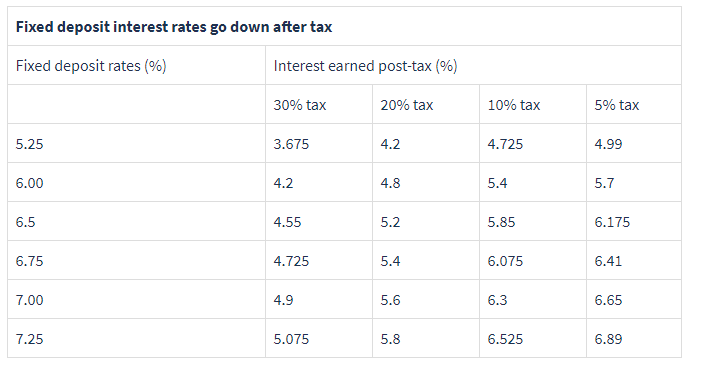

However, one cannot forget that the interest earned is taxed at the income tax slab which eats away most of the interest one earns from the FD.

Image Source: ClearTax

When we talk about investments, our main goal is to earn higher returns, however from the above data it can be noted that the higher your tax bracket, the more you end up paying in tax from the interest you earn from FDs.

If a retiree wants to select appropriate fund as per his risk appetite, return expectation and the financial objective, then there are many options in mutual fund that can offer better flexibility and comparison to FD.

Mutual fund schemes are managed by highly skilled fund managers, therefore, retirees can earn good returns from different asset classes. There are several options to choose.

Debt fund:

This platform is considered as the simplest mutual fund scheme as it offers minimum risk and also provides low-to-moderate returns to investors.

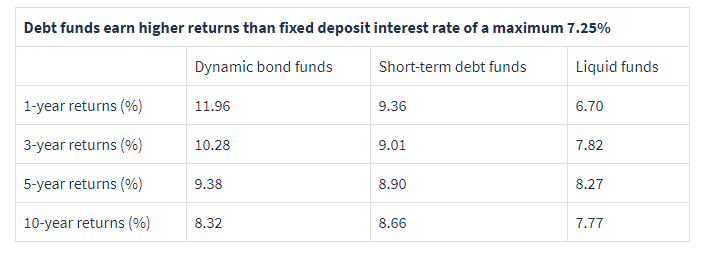

In comparison with FDs, debt mutual funds are more tax efficient.

Image Source: ClearTax

Although short-term returns from debt funds are taxed according to your tax slab, in case of long-term returns they are taxed at 20% after indexation, which can come down to effectively 6-7%.

This means, if you hold a debt fund for almost three years or more, you will only have to pay 6-7% tax disregard to the income tax slab you come under. This provides vast opportunity to earn higher returns.

Balanced Fund:

Balanced funds have capability to give high return with comparatively lower risk than investments in equity funds.

What happens is that if you choose balanced funds then you can invest both in equity and debt instrument - which balances your investment portfolio as per your risk-capacity.

Capital Protection Fund:

As mentioned above, FDs are mostly preferred by retirees because they keep their principal amount intact. Therefore, for them protection mutual fund can be very attractive option.

Under this scheme, out of the corpus that you invest, around 80% is invested in the fixed income securities and the rest 20% is used to invest in equity-related products.

80% of the fund gives you a safe return and ensures that you get sufficient return to rebuild the invested capital during the tenure of the investment, while remaining 20% is used to maximize your return using the equity growth.

Arbitrage Fund:

Such platform usually provides returns from the volatility in the equity spot market and the future market. It carries lower risk than other equity funds and has its profile almost similar like debt funds.

You can enjoy benefit of Long Term Capital Gain (LTCG) tax if your investment period is more than one-year in this scheme.

Bankbazaar in its report said, "Since the stock market is making new highs and volatility in the equity market has increased in the last few years, an arbitrage fund is a good option for retirees."

Therefore, investment in mutual funds appears more practical for retirees than investing their hard earned money in the traditional fixed deposits.

02:06 PM IST

Equitas Small Finance Bank introduces Current Account with 'Sweep In Sweep Out’ Fixed Deposit

Equitas Small Finance Bank introduces Current Account with 'Sweep In Sweep Out’ Fixed Deposit Bank Fixed Deposit: FD investment, interest rates, and more, everything an investor must know to become wealthy

Bank Fixed Deposit: FD investment, interest rates, and more, everything an investor must know to become wealthy SBI fixed deposit rate vs Ujjivan Bank: This small lender offers attractive interest rates to account holders

SBI fixed deposit rate vs Ujjivan Bank: This small lender offers attractive interest rates to account holders It's not just Ujjivan IPO that is attractive, it's Fixed Deposit Rates are high too! Check now

It's not just Ujjivan IPO that is attractive, it's Fixed Deposit Rates are high too! Check now Become rich! Know how to make money the right way! Let Money Guru show you how; check list

Become rich! Know how to make money the right way! Let Money Guru show you how; check list