Invest Rs 1 lakh to earn 37 times more return in 20 years

The best way to save regularly and at the same time maintaining discipline while saving is starting Systematic Investment Plan (SIP).

Investing in Mutual Funds is always advisable despite the risk factor it carries. Investors don't need to be experts on the markets since these investments are made with the help of an army of experts who take the best call possible on where to invest.

The easiest and simplest way to enter mutual funds is systematic investment plan (SIPs).

CHECK MUTUAL FUND PERFORMANCE HERE

But, the question is how much to invest? A lump sum or small amount?

If you have just started investing, the better option is to start with small amount. This will not put burden on your financials. Also, once you get into discipline, then move for higher amount or lump sum.

In a SIP, an investor has to deposit a small sum every month or every quarter and the amount of investment can be as low as Rs 500. If you choose a mutual fund scheme and invest in SIP, based on the plan that you have opted for they will allocate your money in debt or equity.

But, if you invest a big amount in mutual funds at one go, you can earn robust returns.

Look at these three scenarios:

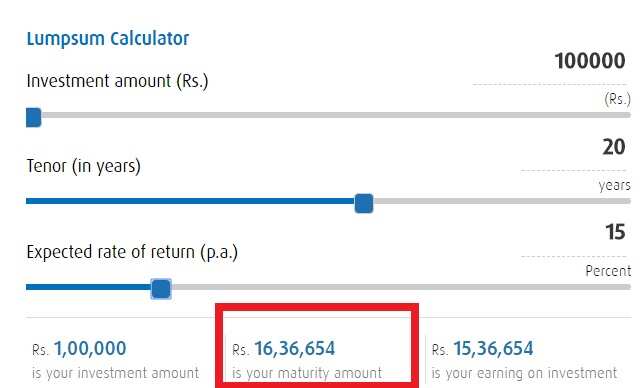

For instance, you invest Rs 1 lakh lump sum amount for a tenure of 20 years with an expected rate of 15% return, at the time of maturity you will get Rs 16,36,654. Which means, your earning on investment is Rs 15,36,654 in 20 years.

The amount of return will rise with an increase of expected rate of return per annum.

Supposedly, you are investing same Rs 1 lakh for tenure of 20 years and the rate of return is 20%, the amount you will get at the time of maturity is Rs 38,33,760, which is Rs 37,33,760 more than your actual investment.

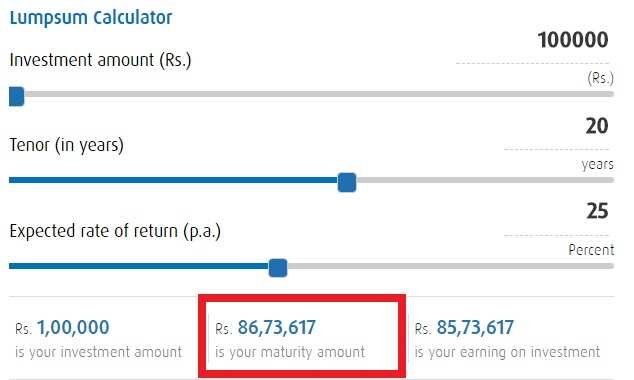

This return will be even more, if the rate is 25%. At the time of maturity, you will get Rs 86,73,617, which is Rs 85,73,617 more than your original investment.

However, if you are still not sure about how to manage the finances, there are always financial planning workshops which will help you to understand more.

Disclaimer: This story is for informational purposes only and should not be taken as an investment advice.

ALSO READ

10:53 AM IST

SEBI comes forward to rescue security investors' interest

SEBI comes forward to rescue security investors' interest #BandKaroBazaar: Market shutdown is a good option: Anand Rathi Chairman of Anand Rathi Group

#BandKaroBazaar: Market shutdown is a good option: Anand Rathi Chairman of Anand Rathi Group Mutual Funds, PPF, NPS to gold — Your powerful guide to accumulate money

Mutual Funds, PPF, NPS to gold — Your powerful guide to accumulate money Turn your Rs 100 per day into Rs 10.72 crore! Here is how to become a crorepati

Turn your Rs 100 per day into Rs 10.72 crore! Here is how to become a crorepati Want to retire rich? Follow this mutual funds investment strategy, say experts

Want to retire rich? Follow this mutual funds investment strategy, say experts