Mutual Funds: Top performers from May 22-May 26

Mutual Funds have been considered as one of the best options for investments as it does not require huge amount to start with.

Though the week started on a muted note, but things turned around on Thursday when markets touched new highs.

With investors filling up their pockets, the next step is where to park the money?

Why not mutual funds? Mutual Funds have been considered as one of the best options for investments as it does not require huge amount to start with.

ALSO READ: GST implementation may increase expense ratio of fund houses

Here's a look at top mutual fund performers of the week from May 22-May 26:

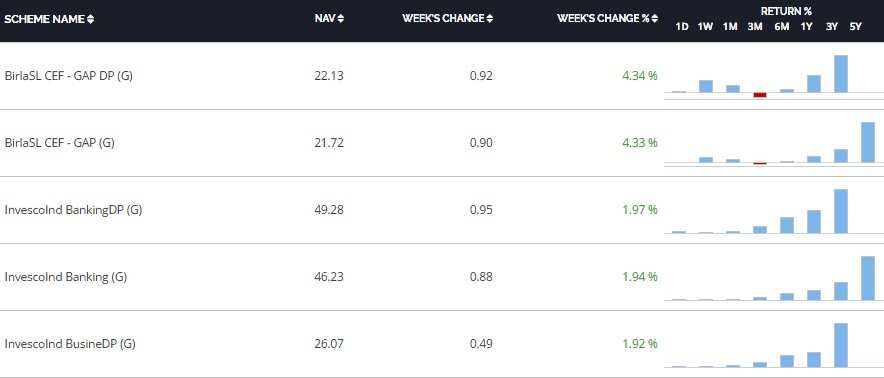

Equity Funds: The top performer in this category during the week was BirlaSL CEF - GAP DP (G) with NAV of 22.13 giving returns of 4.34% and in line with it was BirlaSL CEF - GAP (G) with NAV of 21.72 giving returns of 4.33%.

Third in the list was InvescoInd BankingDP (G) with NAV of 49.28 giving returns of 1.97% and in line with it was InvescoInd Banking (G) with NAV of 46.23 giving returns of 1.94% in one week. Fifth in the list was InvescoInd BusineDP (G) with NAV of 26.07 giving return of 1.92% during the week.

Debt funds: Debt Funds are the funds that invest in debt instruments e.g. company debentures, government bonds and other fixed income assets. They are considered safe investments and provide fixed returns.

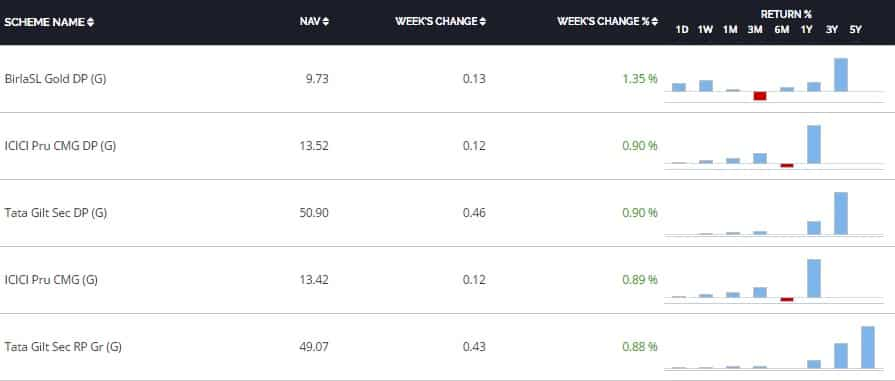

Top performer under this category was BirlaSL Gold DP (G) with NAV of 9.73 giving return of 1.35% and in line with it was ICICI Pru CMG DP (G) with NAV of 13.52 giving return of 0.90%.

Third in the list was Tata Gilt Sec DP (G) with NAV of 50.90 giving return of 0.90%. Then in the list was ICICI Pru CMG (G) with NAV of 13.42 giving return of 0.89%. Fifth in the list was Tata Gilt Sec RP Gr (G) with NAV of 49.07 giving return of 0.88% in one week.

Hybrid Funds: According to BankBazaar, these are funds that invest in liquid instruments e.g. T-Bills, CPs etc. They are considered safe investments for those looking to park surplus funds for immediate but moderate returns.

ALSO READ: Mutual Funds' asset base from smaller cities up 41% to Rs 3.09 lakh crore in FY17

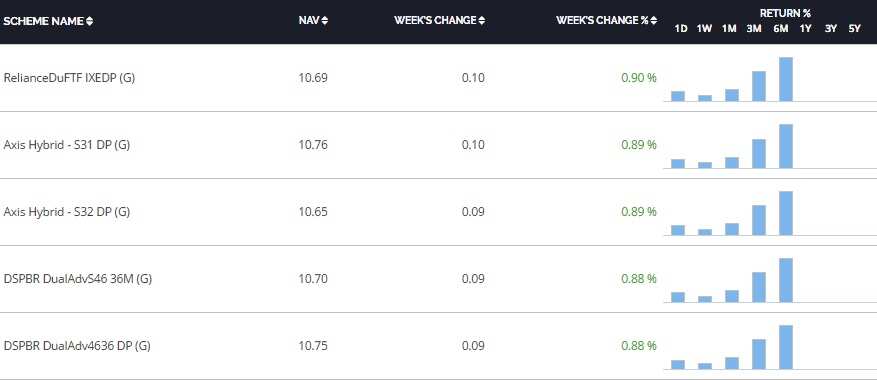

The top gainers under this category was RelianceDuFTF IXEDP (G) with NAV of 10.69 giving return of 0.90%. Then in the list was Axis Hybrid - S31 DP (G) with NAV of 10.76 giving return of 0.89% and in line with it was Axis Hybrid - S32 DP (G) with NAV of 10.65 giving return of 0.89%.

Fourth in the list was DSPBR DualAdvS46 36M (G) with NAV of 10.70 giving return of 0.88% and in line with it was DSPBR DualAdv4636 DP (G) with NAV of 10.75 giving return of 0.88%.

Commodity fund: According to Investopedia, Commodity mutual funds typically invest in both the stocks of companies involved in commodities, such as mining companies, and in commodities proper.

This week, the commodity fund's returns were flat.

Top performer in the list was ICICI Pru GoldSaving (G) with NAV of 10.19 giving return of 0.01% and in line with it was ICICI Pru GoldSav DP (G) with NAV of 10.29 giving return of 0.01% during the week.

Third in the list was CanaraRob GoldSav DP (G) with NAV of 8.84 giving return of 0.25% and in line with it was CanaraRob Gold Sav F (G) with NAV of 8.78 giving return of 0.24%. Fifth in the list was Axis Gold DP (G) with NAV of 9.77 giving return of 0.20% in the week.

Hence, with market outlook remains bullish and experts eyeing positive benefits with new tax regime or goods and service tax (GST) coming into effect, mutual funds should be in your investment bucket list!

Disclaimer: This story is for informational purposes only and should not be taken as an investment advice.

10:57 AM IST

SEBI comes forward to rescue security investors' interest

SEBI comes forward to rescue security investors' interest #BandKaroBazaar: Market shutdown is a good option: Anand Rathi Chairman of Anand Rathi Group

#BandKaroBazaar: Market shutdown is a good option: Anand Rathi Chairman of Anand Rathi Group Mutual Funds, PPF, NPS to gold — Your powerful guide to accumulate money

Mutual Funds, PPF, NPS to gold — Your powerful guide to accumulate money Turn your Rs 100 per day into Rs 10.72 crore! Here is how to become a crorepati

Turn your Rs 100 per day into Rs 10.72 crore! Here is how to become a crorepati Want to retire rich? Follow this mutual funds investment strategy, say experts

Want to retire rich? Follow this mutual funds investment strategy, say experts