Savings account rate cut: Bad times for small savers, time to shift?

Eight major banks have cut the interest rates on savings account to as low as 3.5%. For savings account, higher interest rates are considered better option. This reduction will majorly impact the small savers.

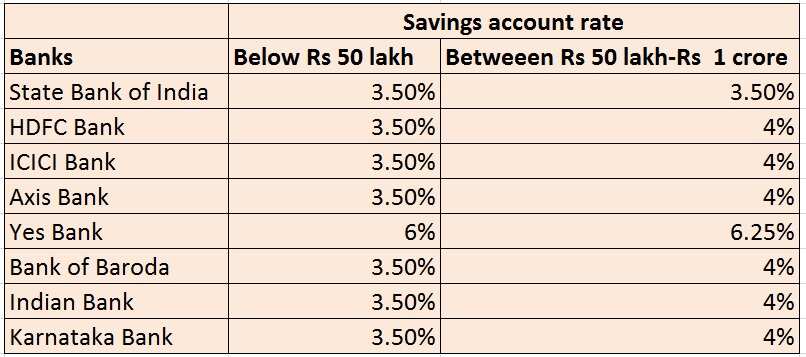

Following India's largest bank State Bank of India (SBI), eight private banks have cut the interest rates of savings account within a week.

SBI, on July 31 had slashed the pricing for under Rs 1 crore saving deposits by 0.50% to 3.5%. After which, major banks, HDFC Bank, ICICI Bank, Axis Bank and five other banks followed the trend.

Savings account, which is considered as the most basic financial product, has become a new "tool" for the banks to reduce liquidity post demonetisation period. It is best suited for salaried employees or people with a monthly income.

Savings account become a better option if the interest rate is high. Which means, with banks reducing the savings account rate, small saver will have to face "bad times" ahead.

Till now, savings account was earning interests in the range of 4-8%. Now, it has reduced to the range of 3.5%-5%, which is the lowest since six years.

This news has come as a major drawback for small savers. On one side, before the roll out of Goods and Service Tax, the government had disappointed small savings schemes such as Kisan Vikas Patra and public provident fund by 10 basis points. On the other, now the banks have cut the rates on savings account to as low as 3.5%.

Time to move ahead?

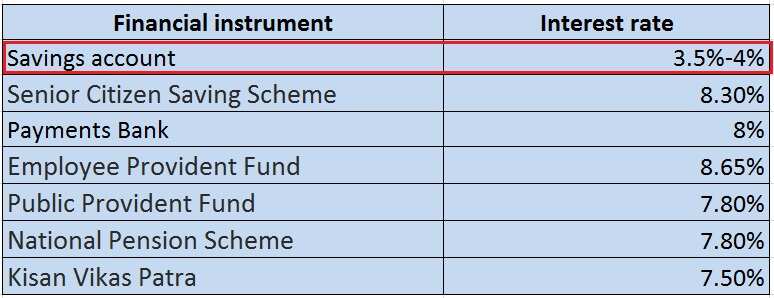

Generally, small savers prefer to put their money in savings account or any low-risk small savings instruments like KVP, National Savings Certificate, Sukanya Samriddhi Account, PPF. However, these schemes still offer higher interest rates as compared to savings account.

Moreover, as compared to savings account, even payments bank and fixed deposits (FDs) offer more interest rates.

Here's a list of financial instruments which have higher interest rates:

ALSO READ:

03:31 PM IST

SBI alert! Your bank deposit may earn less from November 1; Here is how

SBI alert! Your bank deposit may earn less from November 1; Here is how Unable to maintain your monthly balance? Change your savings account to a Basic Savings Bank Deposit a/c

Unable to maintain your monthly balance? Change your savings account to a Basic Savings Bank Deposit a/c Zero Balance Account: Here are some dos and don'ts if you have Basic Savings Bank Deposit (BSBD) Account

Zero Balance Account: Here are some dos and don'ts if you have Basic Savings Bank Deposit (BSBD) Account Bank account holder? Budget 2019 made your bank deposits interest income tax free! Limit hiked; Small savings schemes row solved; Modi govt makes you richer

Bank account holder? Budget 2019 made your bank deposits interest income tax free! Limit hiked; Small savings schemes row solved; Modi govt makes you richer  Budget 2019: Your benefits from fixed deposits, savings to rise? Dear NDA govt, do make bank deposits tax free

Budget 2019: Your benefits from fixed deposits, savings to rise? Dear NDA govt, do make bank deposits tax free