SBI, HDFC Bank debit card holder? Know charges from issuance, ATM transactions to new ATM pin; what you pay to bank

In the first half of FY19, debit card usage at bank ATMs has already reached 798.65 million transactions worth Rs 2,690.60 billion as on September, 2018.

Debit card has become a very important tool in our lives. Apart from mass based identity cards, almost every citizen now has a debit card of his or her own. Significantly, transactions carried out on bank ATM machines using debit cards are growing rapidly. These days debit cards not only just gives you cash, but also access to a host of other freebies and offers. In the first half of FY19, debit card usage at bank ATMs has already reached 798.65 million transactions worth Rs 2,690.60 billion as on September, 2018. This simply points to the fact how deep is the need for a debit card in a person's life.

However, debit cards do not always show you a the best picture. In fact, the list of charges that are being levied on debit cards will make you scratch your head. Two largest lenders State Bank of India (SBI) and HDFC Bank both levy various charges on debit cards right from issuance, ATM withdrawal to ATM pin generation.

If you are a SBI and HDFC Bank customer, then know what your bank is charging you on your debit card usage. Let’s find out.

SBI

For gold and platinum debit card issuance - SBI charges Rs 100 and Rs 306 respectively. Both charges include service tax.

Debit Card Annual Maintenance Charges (Recovered at the beginning of the second year onwards) - stands at Rs 100 for Classic Debit Card, Rs 150 for

Silver/Global /Yuva /Gold Debit Card, Rs 200 for Platinum Debit Card and Rs 300 for Pride/Premium Business Debit Card. These charges also are added with service taxes.

If you are planning to replace your debit card than SBI levies Rs204 (including service tax). As for Duplicate PIN/ Regeneration of PIN, SBI charges Rs 51/- (including service tax.

Transactions carried out at SBI and other ATMs using SBI Debit cards.

Other Bank ATMs - Up to 5 Transactions during a calendar month (for savings bank account only) is free.Meanwhile beyond 5 transactions, if a customer has carried a financial transaction then will be charged with Rs 17(including service tax), as for non-financial transactions a customer will be charged with Rs 6 (including service tax).

Interestingly, there are no extra charges (surcharge) applicable currently for making payments through State Bank Debit Card except the use at fuel stations in India the following charges are applicable:

- For transactions using State Bank Debit Cards on SBI's PoS terminals - 0.75% of transaction value for transactions up to Rs 2,000 or Rs 10 (whichever is higher). Also 1% of transaction value for transactions above Rs 2,000.

- For transactions using State Bank Debit Cards on other Banks' PoS terminals - 2.5% of transaction value or Rs 10 (whichever is higher).

For international transaction charges:

- Balance enquiry - Rs 17 (including service tax)

- ATM Cash withdrawal transactions - Rs 169(including service tax)

Finally, if ATM/Point of Sale (PoS) transaction decline due to insufficient balance, then a customer will be charged with Rs 17 (including service tax)

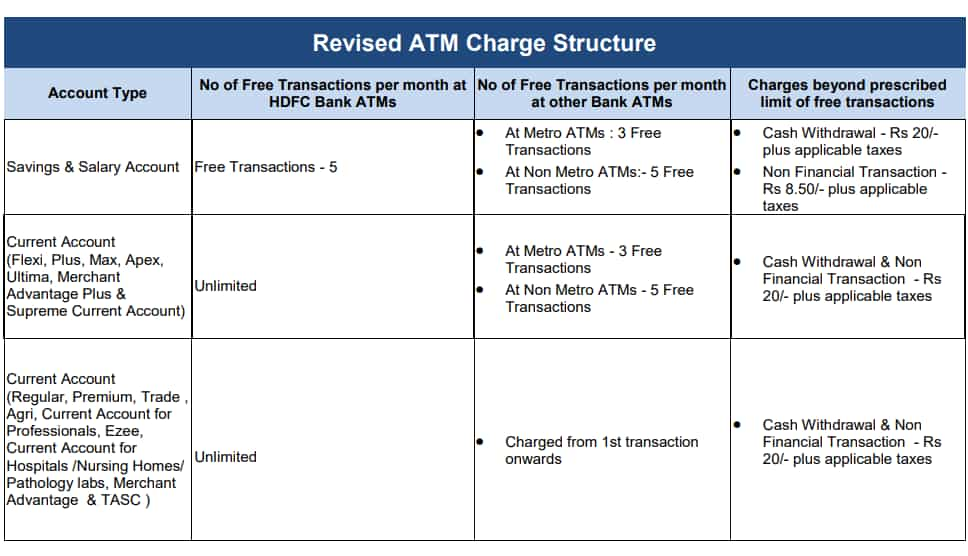

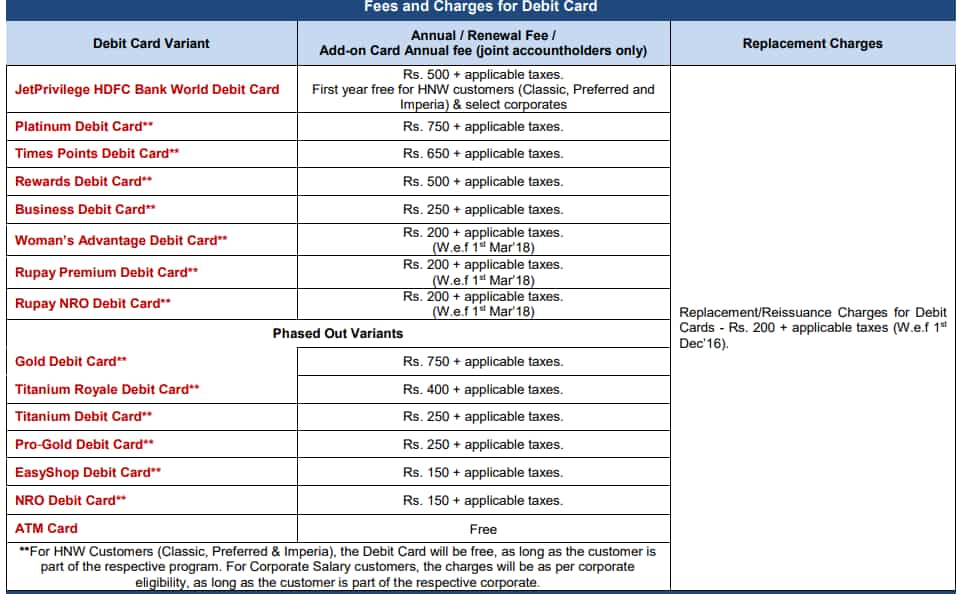

HDFC Bank

Here’s a whole list of charges levied by HDFC Bank on various type of debit cards.

It needs to be noted that, there are no charges for using the Debit Card at domestic merchant locations and websites.

However, at select merchants like IRCTC / railway stations, transaction charges / surcharges as per industry practices will be applicable, by the merchant.

The following are the transaction charges applicable when you use the Debit Card at: Railway Stations: Flat charge of Rs. 30 per ticket + 1.8% of the transaction amount. IRCTC: Transaction charge of 1.8% of the transaction amount.

Fuel Surcharge would not be applicable for the transactions done on HDFC Bank swipe machines at government petrol outlets (HPCL/ IOCL/ BPCL).

For ATM pin generation, HDFC Bank levies Rs 50 plus applicable taxes.

Further, transactions declined at other bank ATMs anywhere in the world or at a merchant outlet / websites outside India due to insufficient funds will be charged at Rs 25 + applicable taxes per transaction.

A 3.5% + applicable taxes on foreign currency transaction carried out on Debit Cards. The exchange rate used will be the VISA/MasterCard wholesale exchange rate prevailing at the time of transaction/merchant settlement.

These are the charges levied on debit card usage on ATMs.

Hence, it is very important to know what type of charges your bank has levied on your debit card related transactions.

07:58 AM IST

PhonePe launches Visa powered unique one-click debit, credit card payment feature

PhonePe launches Visa powered unique one-click debit, credit card payment feature Paytm Bank debit cards, powered by Visa, enabled with international transactions

Paytm Bank debit cards, powered by Visa, enabled with international transactions New rules! Have debit card, credit card? Very important message for you

New rules! Have debit card, credit card? Very important message for you ICICI Bank ATM: Using your debit card or credit card? Do this for sure or you will fall prey to card cloning, skimming scams

ICICI Bank ATM: Using your debit card or credit card? Do this for sure or you will fall prey to card cloning, skimming scams Debit, credit card alert! This feature to be discontinued from March 16

Debit, credit card alert! This feature to be discontinued from March 16