Want to create wealth in Mutual Funds; these 5 schemes can be best bet, here's why

There are wide-range of mutual funds in India like - equity, debt, money market, hybrid or balanced, sector-related, index funds, tax-savings fund and lastly fund of funds.

The mutual fund market is at booming stage, as many investors have opted the route to avail good returns. Investment in mutual funds can give up to 1% to 26% return depending upon the tenure. Mutual fund scheme is a pool of savings contributed by multiple investors. The term ‘mutual’ fund means that all risks, rewards, gains or losses pertaining to, or arising from the investments made out of this savings pool are shared by all investors in proportion to their contributions.

There are wide-range of mutual funds in India like - equity, debt, money market, hybrid or balanced, sector-related, index funds, tax-savings fund and lastly fund of funds.

Recent data of ICRA stated that, smaller towns contributed Rs 4.36 lakh crore to assets under management (AUM) of the mutual fund industry at the end of February 2018, over 41 per cent higher than a year-ago period. Overall, the industry saw the total folio count rise by 2.3 per cent to nearly Rs 7 crore, at the end of February compared with the previous month.

However, AUM of the Indian mutual fund industry came in at Rs 22.20 lakh crore in February, down from Rs 22.41 lakh crore in January.

ICRA also noted that despite the stock markets declining, net inflows into equity mutual fund schemes continued to remain strong. Equity funds (including ELSS) witnessed monthly net inflows of Rs 16,268 crore, up 5.7 per cent month-on-month and more than 150 per cent year-on-year, during February.

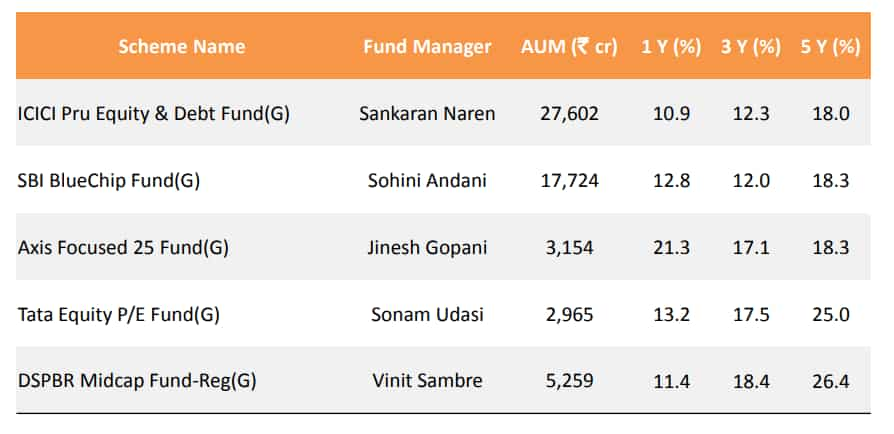

Hence, in case if you plan to invest in mutual fund market, here’s a list of five schemes where you can park your money, as they are believed to perform well in coming days, as per IIFL Research report.

IIFL in it’s report says, “To create wealth for investors, we have short-listed five mutual funds as follows.”

ICICI Pru Equity & Debt Fund (erstwhile ICICI Pru Balanced Fund)

It is an equity-oriented balanced fund, which does tactical Asset Allocation allocation between debt and equity, based on the market outlook to ensure optimal risk reward.

As of March 2018, the fund had invested ~67% of AUM in equity to give steady growth over long term, while ~26% is allocated to debt investments to cap the downside risk. The fund has invested ~60% of the AUM in large-cap stocks, while ~7% is invested in mid-cap and small-cap stocks.

Investors who want to follow balanced approach i.e. 65% equity and ~35% debt can invest in the scheme to create wealth in long term.

SBI BlueChip Fund

It is an equity fund, which primarily invests in top 100 stocks by Asset Allocation market capitalization.

The fund invests in companies which have significant market share and are market leaders in their industries.

As of March 2018, the fund had invested ~75% of AUM in large-cap stocks and ~14% was allocated to mid-cap and small-cap stocks to give steady growth over long term. The fund had highest allocation to Private Banks (~15%), followed by Pharma (~6%) and FinanceNBFC (~6%)

Investors who want to primarily invest in large-cap stocks can invest in this fund to create wealth in long term.

Axis Focused 25 Fund

It is an equity fund that invests in high conviction stocks, Asset Allocation maximum 25 stocks, from top 200 stocks by market capitalization.

The fund’s strategy is to invest in quality companies with credible management, sustainable profit growth and cash flow, and having clean balance sheet.

As of March 2018, the fund has invested ~62% of AUM in largecap stocks and ~31% is allocated to mid-cap and small-cap stocks to give steady growth over long term. Investors who want to take exposure in high conviction large-cap and mid-cap stocks can invest in the fund to create wealth in long term.

Tata Equity P/E Fund

It is a value conscious equity fund, which aims to invest 70-100% Asset Allocation of its AUM in stocks whose 12 months rolling PE ratio is lower than 12 month rolling PE ratio of BSE Sensex.

The remaining AUM is allocated in other equity and debt instruments.

As of March 2018, the fund has invested ~61% of AUM in largecap stocks and ~28% is allocated to mid-cap and small-cap stocks to generate higher returns over long term. Investors who are value conscious and want to invest in large-cap and mid-cap stocks can invest in the fund.

DSP BlackRock Mid Cap Fund

It invests in stocks beyond top 100 companies, based on market Asset Allocation capitalization.

The fund manager invests in small-cap and mid-cap stocks with consistent earnings and significant growth potential.

It follows bottom-up approach to select the stocks.

As of March 2018, ~59% of its AUM was invested mid-cap stocks, ~15% was invested in large-cap stocks and ~21% in small-cap stocks to generate high returns for investors.

Investors who want to primarily invest in mid-cap and small-cap stocks can invest in this fund to create wealth in long term.

It needs to be noted that, the more higher the tenure for investment in mutual funds, the higher return you receive on your money.

12:45 PM IST

Money Tips For Investors: Zee Business expert reveals strategy to follow

Money Tips For Investors: Zee Business expert reveals strategy to follow Hot Money Tip: How to earn wealth and achieve your financial goals?

Hot Money Tip: How to earn wealth and achieve your financial goals? Money making tip: Which mutual fund is better-suited to achieve long-term investment goal?

Money making tip: Which mutual fund is better-suited to achieve long-term investment goal? Money tip! Direct Fund vs Regular Mutual Fund: Which one will give you more money? Know here

Money tip! Direct Fund vs Regular Mutual Fund: Which one will give you more money? Know here Facing financial crisis? No worries! These investments may bail you out - Here is how

Facing financial crisis? No worries! These investments may bail you out - Here is how