Fashion and apparel overtake gadgets and mobile phones as top categories on e-commerce sites in India

From books to smartphones to fashion products, Indians online shoppers are slowly changing trends. Sale of fashion apparel on e-commerce sites have rapidly improved Amazon and Flipkart fashion heads tell Zeebiz.

Key Highlights

- Indians are changing online shopping trends from books to smartphones to now the upcoming fashion apparel.

- Close to 60% of all customers prefer fashion, says Flipkart. While Amazon said sale of fashion brands were growing 11 times faster.

- Indian fashion apparel market is growing nearly 25% YoY, approximately $17 billion industry.

Imagine you’re in the 1990s, with a dial-up internet connection and a chance to shop for clothing and fashion apparel online from an e-commerce site that you have never heard of.

Would you give into your shopping urges?

The trend of online shopping has evolved with the age of the internet in India. And a major cause of this phenomenon was trust issues of the Indian consumer that kept the online shopping experience to buying books.

Back then when Rediff, Sify, HomeShop18 and eBay ruled the ways of the World Wide Web in India, Flipkart and Amazon were yet to be discovered and books were the preferred products bought online.

In 2013, after its launch in primarily books and consumer appliances, Flipkart officially forayed into fashion with an advertisement tagline – ‘Fashion has a new address.’

The same year saw Amazon’s debut into fashion and lifestyle with the launch of fashion jewellery and watches.

The companies gradually expanded its portfolio into men’s wear and to include more brands and so shoppers shifted from buying books and smartphones to more of fashion apparel online.

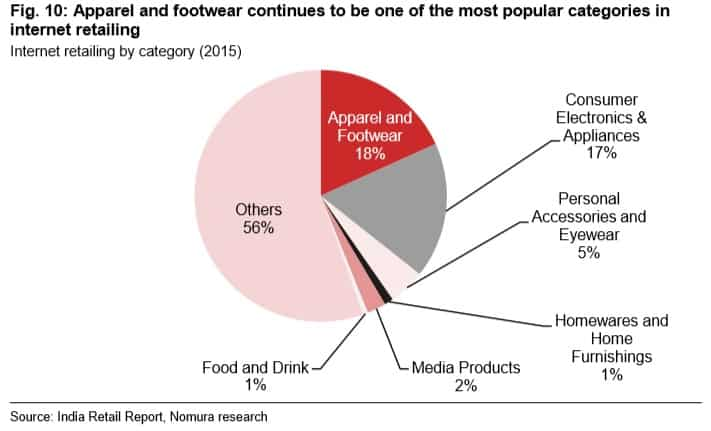

Of all the internet retailing sales in 2015, fashion apparel comprised 18% and consumer appliances was at 17%, as per a report by Nomura dated January 16.

The branded apparel market in India was set to double to $30 billion by 2021, investment analyst at CLSA, Chirag Shah said in a report dated May 20, 2016.

“We expect 20-25% YoY growth in branded apparel segment vs 6% demand growth for apparel sector (as highlighted in the report),” Shah said speaking on current growth trends in the sector.

This market is currently estimated to be a $15-17 billion market in India. Shah said this was inclusive of online brands that shoppers could choose from.

With ample demand the e-commerce companies are also ramping up on opportunities for shopaholics to indulge with Amazon rolling out its Great Indian Sale and Flipkart that just concluded its Big 10 sale.

“Global precedent suggests that local apparel industries undergo J-curve expansion when a country’s GDP per-capita increases to over $2,000, Shah said adding, “the top-three Indian brands have combined sales of less than $1 billion providing a long term opportunity as the economy progresses towards this inflection point (with a current GDP per-capita of about $1,700).”

Dressing to the nines

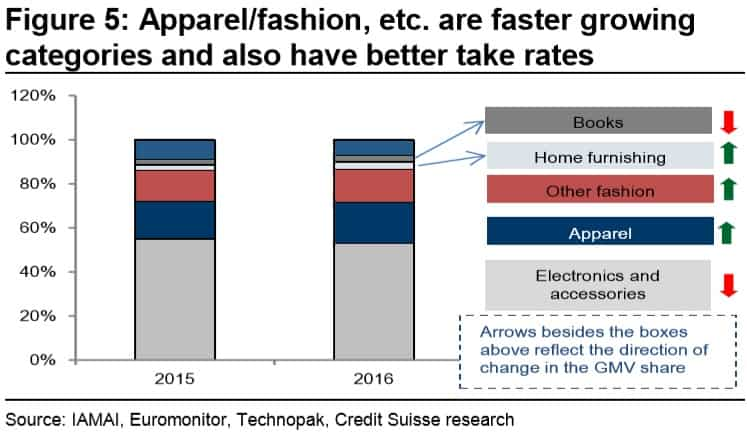

A shift away from ‘low margin electronics’ onto fashion apparel was noticed by analysts Anantha Narayan and Nitin Jain from Credit Suisse in a report dated January 12.

“The average commission rate charged by Flipkart and Amazon India is ~15% for apparel, about 11% for other fashion products,” the Credit Suisse analysts said.

Also Read: Once fuelled by it, can India's e-commerce boom continue to rely on mobile phones?

“Flipkart Fashion which is a part of our Lifestyle umbrella, is one of our ‘high-focus’ categories. Close to 60% of all customers on Flipkart are now transacting in fashion categories.” Rishi Vasudev, Head Flipkart Fashion told Zeebiz.

The home grown e-commerce site said that there has been increased traction from both men and women and sales only helped its company margins.

“Over 40% of Flipkart Fashion’s offerings during the sale were special merchandise units exclusively developed by well established brands for Flipkart, across men’s and women’s fashion such as Lee, Wrangler, Puma, Woodland, Fossil, Carlton London, Chemistry and Ferrari to name a few,” Vasudev said.

“During the ongoing Big 10 Sale, there has been a 3x increase in female shoppers on Flipkart Fashion as compared to non-sale days on the back of several attractive offers across fashion categories for women,” Vasudev added.

Amazon on the other hand claimed that it has over two million fashion products and 15,000 fashion brands.

Zeebiz spoke to Arun Sirdeshmukh, Head, Amazon Fashion who said that the company has signed 150 fashion brands with its site.

"Amazon.in, the largest e-commerce, has been consistently the most visited e-commerce site in India with traffic from over 97% of India’s serviceable pin codes that offers products across all categories. Almost 30% new customers for Amazon.in come from Amazon Fashion. Our apparels category is one of the top performing categories on amazon.in and was the highest selling product category by units, for Amazon.in in the recently concluded Great Indian Sale,” Sirdeshmukh said.

While some of the ‘best deals’ on Flipkart included - Samsung Galaxy, Google Pixel, Apple iPhone 6S, Panasonic HD TV, Air Conditioner brands and Moto G5 Plus all with discounts up to 15-20%.

However, despite its offers on consumer electronics the company said this helped in improving sales of other categories.

“On day 2 of the sale (May 15), Flipkart was seen promoting deals on mobiles which led to a huge spike in sales of relevant cross categories like men's clothing and men's footwear,” Vasudev said.

New launches

Home to brands like Tommy Hilfiger, Vero Moda, Adidas, Puma, Reebok, Amazon.in has launched 150 new brands.

Amazon told Zeebiz that high street fashion brands sales were growing at a faster pace.

“It is interesting to note that brands like Arrow, Levis, Fila, Sparx, Woodland saw growth upwards of 11 times,” Sirdeshmukh said.

Further he added, “Majority of our top fashion brands saw a spike of over nine times across categories. This shows the demand for such brands on the platform.”

"Premium watches is another sub-category that has performed well with premium brands like Casio, Citizen and Times clocking upwards of 6X. Handbag brands like Caprese, Baggit, and Hidesign have grown upwards of 11X, 13X and 8X respectively (all in terms of units sold compared to a regular day)," Amazon's Sirdeshmukh said.

Flipkart also launched a ‘refresh’ campaign in January this year which was to offer customers trendy fashion at affordable pricing.

“With the help of over 100+ fashion experts, the refresh campaign has helped customers to solve the confusion of fashion trends resulting in the highest historical ever new customer acquisition to date with 60% repeat customer base every month,” Vasudev added.

Flipkart claimed the Big 10 Sale garnered millions of customers and from all over India.

“Close to 40% customers are from tier III towns and below. We have witnessed a 15% increase in the average time spent by customers on Fashion categories and a 25% increase in the numbers of styles & products being browsed in every session since the campaign was launched,” Vasudev said.

10:46 AM IST

Coronavirus Lockdown: Get free home delivery of food, more, just call WhatsApp number

Coronavirus Lockdown: Get free home delivery of food, more, just call WhatsApp number App-based cabs to work as delivery support for e-commerce, retailers? Check this request

App-based cabs to work as delivery support for e-commerce, retailers? Check this request Amazon, Flipkart challenge new Indian tax on online sellers

Amazon, Flipkart challenge new Indian tax on online sellers Amazon Sale 2020: Holiday sales jump as one-day shipping pays dividends, stock up 13%

Amazon Sale 2020: Holiday sales jump as one-day shipping pays dividends, stock up 13% Amazon chief Jeff Bezos said 21st Century belongs to India; check what Narayan Murthy, Infosys co-founder said

Amazon chief Jeff Bezos said 21st Century belongs to India; check what Narayan Murthy, Infosys co-founder said