Grocery delivery start-ups get ahead of food delivery start-ups in funding

Grocery delivery start-ups have raised almost $600 million more than food delivery start-ups so far in 2017

While the market has been tough for the food delivery start-up market, the grocery delivery start-ups have seen an upswing in investment from venture capitalists (VCs).

Even as deal activity in the food delivery sector as a whole continues its downward trajectory, grocery delivery startups continue to pull ahead of meal delivery startups in both deals and dollars. Grocery delivery start-ups have raised almost $600 million more than food delivery start-ups so far in 2017, according to a CB Insights report.

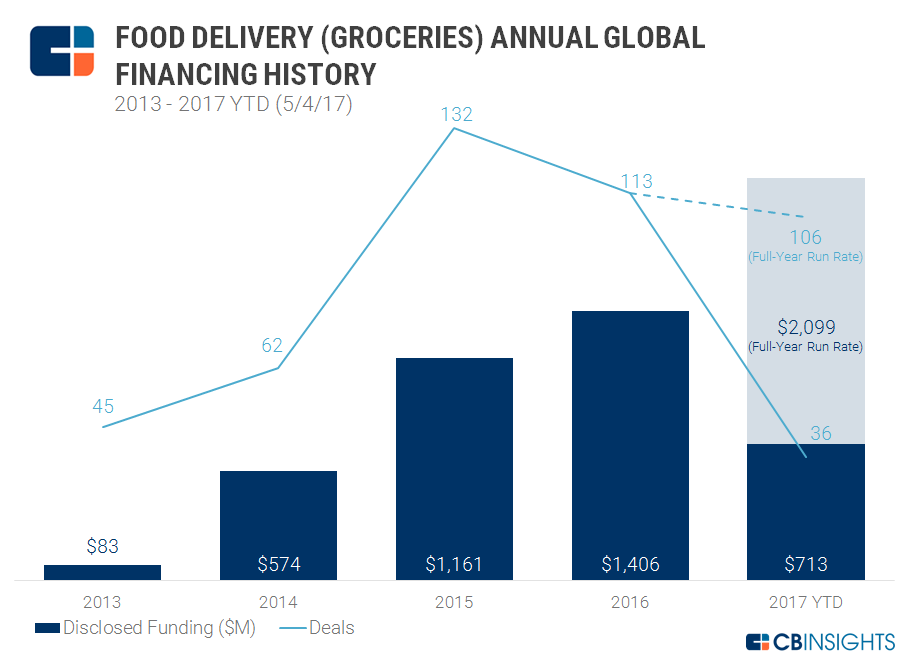

Source: CB Insights

Grocery delivery start-ups have raised globally have raised $713 million in 2017 till date from 36 deals. It is expected to grow to $2 billion by the end of the year from 106 deals.

This is a large growth in the funding for grocery delivery start-ups, which was at $1.4 billion in 2016. The growth from 2015 was not much as it stood at $1.1 billion.

This can be seen even in India as grocery delivery start-ups have been doing well, especially after demonetisation with a rise in people ordering online. For instance, Big Basket raised Rs 45 crore in March this year from Trifecta Capital. Last year it had raised $150 million in fresh funding. Grofers had raised $120 million in funding at the end of 2015.

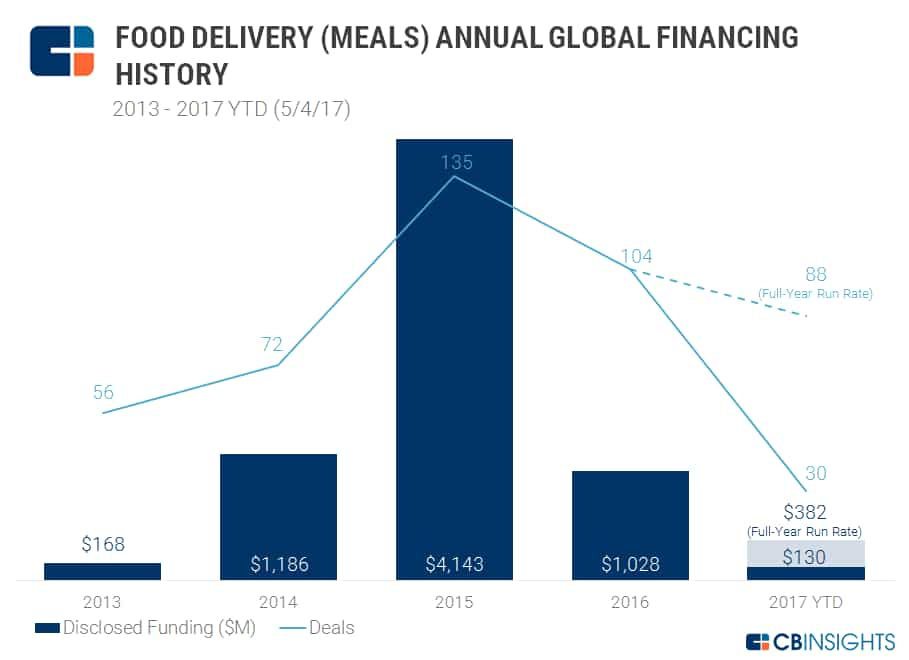

Source: CB Insights

While Instacart’s $400 million Series D round of funding in Q1 2017 accounts for a large portion of dollar investment in the grocery delivery space, deal activity to grocery delivery startups had already begun to pull ahead of activity to meal delivery startups starting in 2016, said the report.

Food delivery start-ups have just raised $130 million from 30 deals and is expected to only generate funding of $382 million from 88 deals. It has declined from $1.02 billion in 2016 from 104 deals. A large drop in funding from what it received in 2015 where it received $4.14 billion during the year.

This trend can be seen even in India as food delivery start-ups have been facing a lot of issues in funding. Many food delivery start-ups had to shut shop or be acquired over the last two years. For instance, TinyOwl was Roadrunnr in 2016, FoodPanda was acquired by Delivery Hero. Other food delivery start-ups just ended up closing include Zupermeal, iTiffin, EazyMeals, Zeppery and BiteClub.

02:30 PM IST

Now, food delivery to wherever you are possible with UberEATS

Now, food delivery to wherever you are possible with UberEATS Will Amazon succeed in the online grocery business where other start-ups have failed?

Will Amazon succeed in the online grocery business where other start-ups have failed? Over 50% people switched to online grocery shopping after demonetisation: Survey

Over 50% people switched to online grocery shopping after demonetisation: Survey Amazon.In expands grocery, household service to 6 more cities

Amazon.In expands grocery, household service to 6 more cities Indian online food delivery grows by 150% in volumes in 2016

Indian online food delivery grows by 150% in volumes in 2016