Want to open your own business? Here’s an easy way to register your startup in India

A startup is defined as a newly established business, usually small, started by one or a group of individuals.

Unique, citizen centric, long term and economic driver are few words to describe many successful startups in India. Some of the Indian startups are already challenging various companies overseas. For example, Zomato and Swiggy changed the way we order food, while Ola is taking on Uber. Then there is Paytm which initially came as a payment app and now helps you shop, make investments and buy from app. Not to forget, Flipkart. What began as a book selling online portal, has become the leader of e-commerce segment, rivaling against Jeff Bezos’ Amazon. Alos, there is OYO which helps you to book hotels in advance at affordable price. Other few big names are MakeMyTrip, Big Basket, Delhivery, Grofers, Furlenco and BYJU’s, etc. Even though they different from each other, these are all successful startups.

Ratan Tata who is an active investor in some major startups like Paytm, Snapdeal, Zivame, Ola, Xiaomi, CarDekho, Bluestone and Urban Ladder, sees Indian startups as the future of the country. Despite swaying Indian economy and markets with its various Tata companies, Ratan once said, “Young people are the future of the country, and new startups embody the creativity and innovation of young people.”

Yes, it is right that startups must have a unique business model which helps not only help Indian economy but also citizens widely. However, one of the most common method to make a startup is their registration. Hence, if you are planning to open your own business, then here’s how you must register for startups with the help of Startup India.

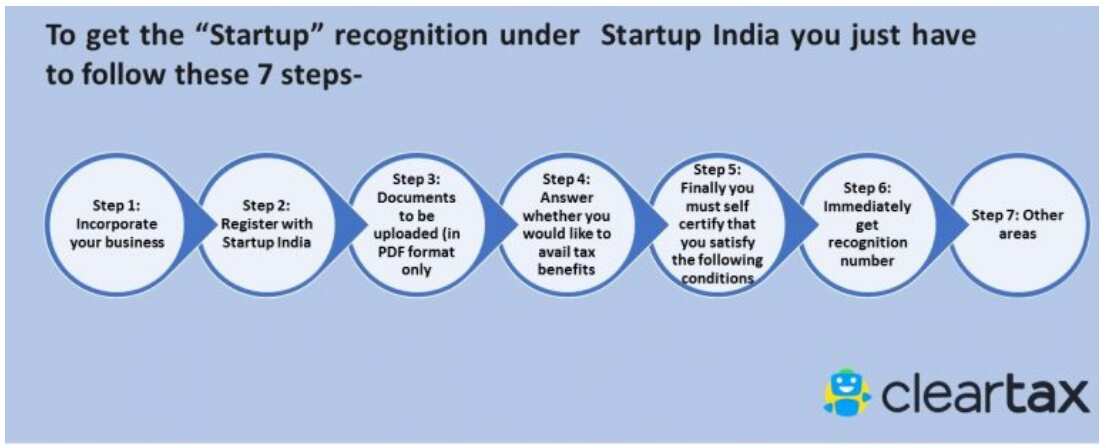

Registration for startup in India, have become quite easy! In fact one can register their startup by following just 7 steps, as per ClearTax.

Incorporate your business!

This is one of the most important part which you should make sure your startup is clear off. To begin a startup, you must first define it as a private limited company (PLC) or partnership firm or limited liability partnership (LLP). The meaning of private limited company is that, there is a limited liability or legal protection for their shareholders. Whereas, best way to define LLP is that, the firm has limited liability and interference for their members. Also, in LLP, partner and firm are considered as separate entity, hence, the former’s role is limited to the amount he or she has invested in the company. On the other hand, partnership firm is when two people agree to share their profit, losses and decision making.

Once decided which type is your business, then you will have to follow procedures of registration which will need details like obtaining the certificate of incorporation or partnership registration, PAN and other required compliance.

2. Register with Startup India!

Every new business must be registered as startup, which can now be done in simple steps and online. All a startup members have to do is log on to the Startup India website aka www.startupindia.gov.in. You can create your startup India account on the website. Once done, you will need to fill a form with details of your business and upload required documents.

3. Documents needed!

It needs to be noted that, a letter of recommendation is a must to be submitted along with registration form. As per ClearTax, any of the following will be valid:

A recommendation (regarding innovative nature of business) from an Incubator established in a post-graduate college in India. Or

A letter of support by an incubator, which is funded (in relation to the project) by Government of India as part of any specified scheme to promote innovation. Or

A letter of recommendation (regarding innovative nature of business), from an Incubator, recognized by the Government of India. Or

A letter of funding of not less than 20% in equity, by any Incubation Fund/Angel Fund/Private Equity Fund/Accelerator/Angel Network, duly registered with SEBI. Or

A patent filed and published in the Journal by the Indian Patent Office.

Apart from this, you will also be needed to upload the certificate of incorporation of your company. However, registration certificate if its a partnership company will be required.

Additionally, you will need to upload a brief description of the nature of your business or products.

4. Select whether want to opt for tax benefits.

At present, a startup can avail the benefit of tax exemption for up to three years under section 80-IAC of Income Tax Ac. However, for availing this benefit they must register with Inter-Ministerial Board (IMB) for full deduction on the profits and gains from business. A startup which is recognized by DIPP or government of India, is eligible for IMB. For being recognized by DIPP, a company must be PLC or LLP, incorporated on or after April 01, 2016 but before April 01,2021 and must have product & services or processes undifferentiated.

Tax deduction is allowed for any three consecutive years out of seven years from the year the business was incorporated.

Furthermore, tax exemption is allowed on investments above fair market value received under Section 56 of Income Tax Act. For this benefit, a startup should be DPIIT recognised and aggregate amount of paid up share capital and share premium of the startup must not exceed Rs 25 crores.

5. Self-certify your business

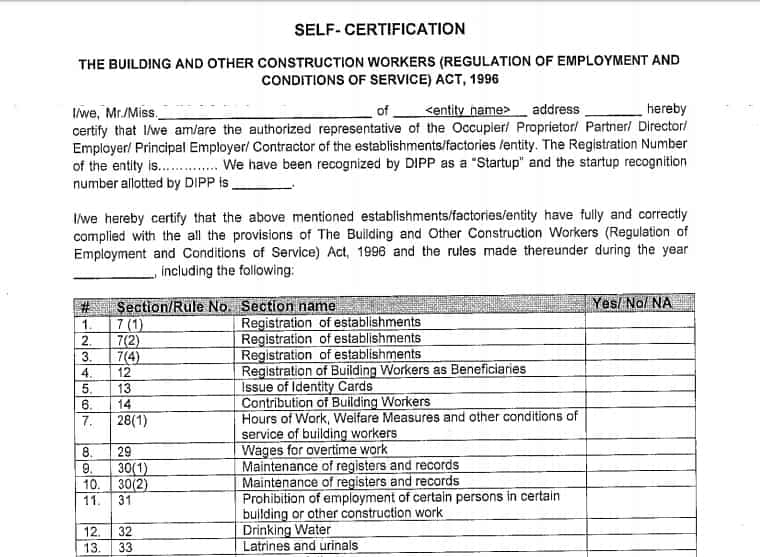

A Startups is allowed self-certify compliance in respect of following Labour Laws:Other Constructions Workers’ (Regulation of Employment & Conditions of Service) Act, 1996; The Inter-State Migrant Workmen (Regulation of Employment & Conditions of Service) Act, 1979; The Payment of Gratuity Act, 1972; The Contract Labour (Regulation and Abolition) Act, 1970; The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 and The Employees’ State Insurance Act, 1948.

Other conditions which are needed for self certifying a startup is that, you must register your new company as PLC, LLP or partnership firm. Also business must be incorporated/registered in India, not before 5 years. Further, turnover should be less than Rs 25 crore per year, innovative and unique busines module and finally the startup should not be a reconstruction of an existing business.

Here's a glimpse of self-certifying form looks like.

6. Recognition number!

Once applied, you will get immediately a recognition number for your startup. But the certificate of recognition will be issued after examining your documents.

7. Other areas!

a) Patents, trademarks and/or design registration:

If you want patent, trademark or design registration for your innovative business or products, then you can easily avail any from the list of facilitators issued by the government. Notably, you will have to bear only the statutory fees thus getting an 80% reduction in fees.

b) Funding:

Money is the bread and butter of every startup. ClearTax in its report highlights that, due to lack of experience, security or existing cash flows, entrepreneurs fail to attract investors. Besides, the high-risk nature of startups, as a significant percentage fail to take-off, puts off many investors.

If you need funding support, you can always knock the doors of government as the centre has set up an initial corpus of Rs 2,500 crore and a total corpus of Rs 10,000 crore over a period 4 years. But like the above mentioned successful startups which creates difference in the country, can bag attention of many domestic and global investors. Hence, make sure your startup is innovate and a booster for not only upper class, but the middle and lower class of India.

Thereby, it has become very easy for registration of a startup thanks to government. Hence, do not let your creative ideas stop, create your own firm and change the world!

06:29 PM IST

Attractive idea! Pension funds may be allowed to invest in startups - Check Modi government plan

Attractive idea! Pension funds may be allowed to invest in startups - Check Modi government plan Unicef lauds Skill India, Start-up India initiatives

Unicef lauds Skill India, Start-up India initiatives Startup India: Health solutions innovator Agatsa raises $1 million

Startup India: Health solutions innovator Agatsa raises $1 million Startup India: Planning ṭo start own venture? Top 5 things to look at

Startup India: Planning ṭo start own venture? Top 5 things to look at  Five power women driving India's startup investment ecosystem

Five power women driving India's startup investment ecosystem