The Economic Survey 2016-17 said that excess capital with Reserve Bank of India (RBI) should be remitted to the Government.

The Survey said, "Last year’s Economic Survey had raised the issue of the government’s excess capital in the RBI. That issue could become even more salient this year because of demonetisation."

In the last Economic Survey 2015-16, Subramanian had called RBI's capital as one possible source of resource to curb bad loans of public sector banks.

"There is no particular reason why this extra capital should be kept with the RBI," the Survey said.

Assuming that the RBI returns Rs 4 lakh crore of capital to the government, what are the uses to which this capital can be put? it questioned.

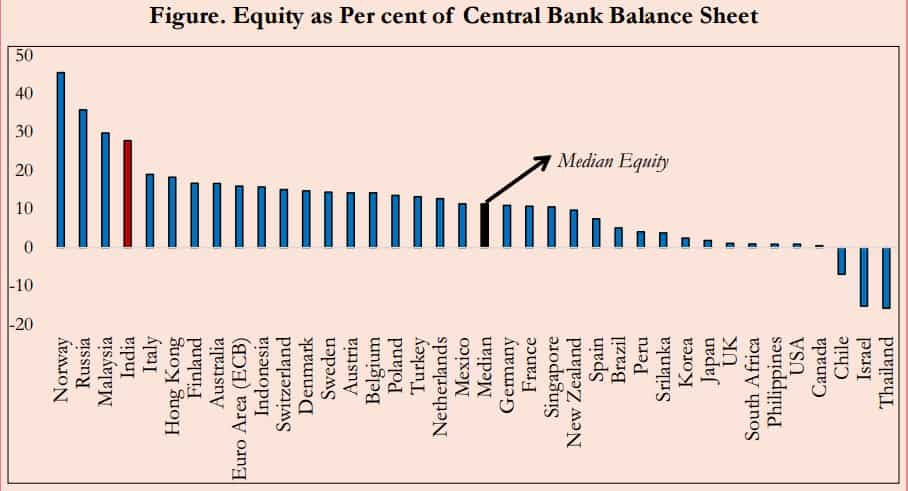

Even at current levels, the RBI is already exceptionally highly capitalised (see chart above). In fact, it is one of the most highly capitalised central banks in the world. "So, it would seem to be more productive to redeploy some of this capital in other ways," Economic Survey said.

Hence, the Survey felt that the money could be used for recapitalising PSBs and could also used infused in the Public Sector Asset Rehabilitation Agency (PARA).

More than four fifths of NPAs (bad loans) were in PSBs and reached double-digits of 12% as on September 31, 2016.

Secondly, the capital could also be used for extinguishing debt to demonstrate that the government is serious about a strong public sector fiscal position, it said.

Interestingly, ex-RBI Governor Raghuram Rajan had opposed the move and brought in various measures that could support Indian banks capital need.

Rajan had said, “A better idea would be if the central bank pays the government the maximum dividend and the sovereign in turn funds the banks' capital needs.” Adding he said, “Government can also issue

"Government Capitalisation Bonds" to tide away with the capital problem."

The Survey said, "There are prominent international precedents for governments using its capital in the central bank for its own purposes; and for benefiting from the extinguishing of bank notes and using the excess capital in the central bank."

The US Federal Reserve gave $19 billion from its surplus capital to finance transportation projects in 2015. In 2004, the Bundesbank, extinguished its old deutsche mark currency and counted it as income in the profit and loss account because it was deemed highly unlikely that these would ever be exchanged for euros. The Bank of Israel recorded a gain of ILS 220 million in its 2010 financial statements (about $62 million at the time) for the face value of notes that had passed the legal date for exchange and were no longer valid for use, the Survey argued.

07:10 PM IST

Is Indian economy better prepared to deal with COVID-19 than it was during 2008 Global Financial Crisis?

Is Indian economy better prepared to deal with COVID-19 than it was during 2008 Global Financial Crisis? Three-month home loan EMI waiver hailed by realty sector; what they said

Three-month home loan EMI waiver hailed by realty sector; what they said Have EMIs to pay? WAIVER relief for home loan, auto loan takers! No need to pay for 3 months

Have EMIs to pay? WAIVER relief for home loan, auto loan takers! No need to pay for 3 months Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps

Zee Business Impact: RBI puts stamp of approval on Anil Singhvi's demand to cut repo rate by 75 bps RBI Repo Rate cut announced; EMI payment delay to loan rates, check top 5 takeaways

RBI Repo Rate cut announced; EMI payment delay to loan rates, check top 5 takeaways