'Do or die' moment for Indian mobile phone brands in 2017: Report

The re-entry of Nokia in Smartphones and exist of smaller players will be some of the important factors driving the Indian Mobile Handset Market.

The mobile phone market in India recorded a 22% rise in revenues at Rs 1.35 lakh crore in 2016 as against Rs 1.11 lakh crore in 2015, according to CMR's Indian Annual Mobile Handset Market Review.

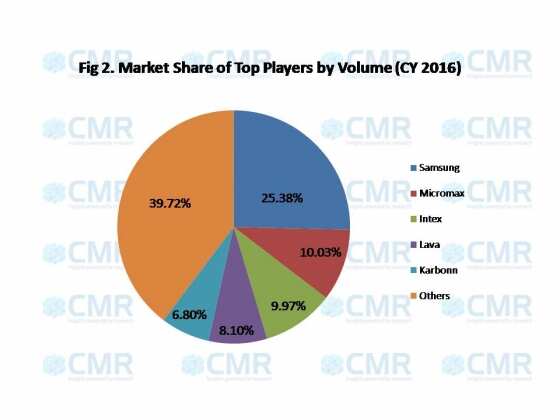

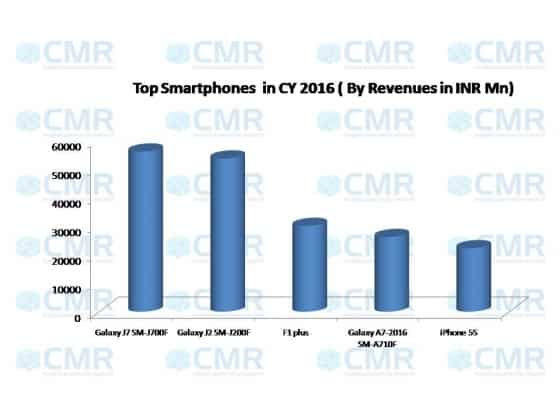

Samsung still led the market in India garnering 33% market share during the year with its revenues standing at Rs 45,371.3 crore, followed by Apple (8%) and Lenovo (7%) with Rs 11,297.5 crore and Rs 9,980.6 crore revenues, respectively.

Source: CMR Research

The report further said that 4G revenues of the industry increased by over 100% to Rs 9,927.4 crore in CY 2016, while 3G declined by about 60% to Rs 16,597.8 crore.

CMR believes that in 2017 there would be major knock offs and the industry will see consolidation.

“2017 is going to be a disruptive year as vendors come out with their unique propositions such as more RAM, higher battery capacities, among others. The re-entry of Nokia in Smartphones and exist of smaller players will be some of the important factors driving the Indian Mobile Handset Market. In a nutshell, 2017 is going to be a ‘Do or Die’ year for many of the brands,” said the report.

Source: CMR India

The CMR report also predicted that in 2017 4G-capable feature phones are going to cannibalise the below Rs 5,000 smartphone market. The buzz would be around making the feature phones smarter with upgraded cameras and introduction of new features, it said.

“Although, the revenues from feature phones constitute a very small chunk of around 14%, in terms of volume they hold about 57% of the market. Overall, there’s a scope to play around feature phones and brands like itel, Zen and Ziox would get aggressive in this space,” said the report.

The war between Indian mobile phone brands (Micromax, Intex, Lava, Karbonn) and Chinese (Lenovo, Oppo, Vivo and Xiaomi) brands is going to be aggressive. In CY 2016, in terms of volume the total market share of Indian brands stood at 35%, while for Chinese brands it was at 10%. However, in terms of value, Chinese brands managed to beat Indian brands, with the combined revenue of former standing at 22% as against 17% of latter. Indian brands need to brace themselves up for a terrific war against the Chinese players, it said.

Source: CMR India

The Indian players would look forward to Rs 6,000-Rs 10,000 smartphone market, where they will primarily fight it out with Xiaomi and Lenovo, having wide portfolio in this segment as well. The Rs 5,000-10,000 market is going to see some new specs and upgrades, it added. In the premium segment, new models of Samsung, Apple and OnePlus would be worth to watch.

It further said that ‘Make in India’ has provided the right impetus to the mobile manufacturing in the country. Today, about 66% of the total shipments are domestic manufacturing, in 2017, the share would touch 90%.

In terms of technology, 4G is going to be synonyms to smartphones. Feature phones would be here to support the voice-centric market. In CY 2016, 4G constituted about 69% of total smartphone shipments, while 3G was 29%. In CY 2017, 4G is all set to cover near 100% of Smartphones.

06:14 PM IST

Huawei unveils P10, P10 Plus smartphones at MWC 2017; here are the specifications, price

Huawei unveils P10, P10 Plus smartphones at MWC 2017; here are the specifications, price The 145 million feature phone market in India that Nokia can target with 3310

The 145 million feature phone market in India that Nokia can target with 3310 Nubia unveils latest range of smartphones at MWC 2017

Nubia unveils latest range of smartphones at MWC 2017 Chinese companies infringe copyright of Indian brands; sell fake products

Chinese companies infringe copyright of Indian brands; sell fake products  Here are some of the best smartphones priced under Rs 13,000

Here are some of the best smartphones priced under Rs 13,000