Have India's tax avoidance treaties with Cyprus, Mauritius already started giving results?

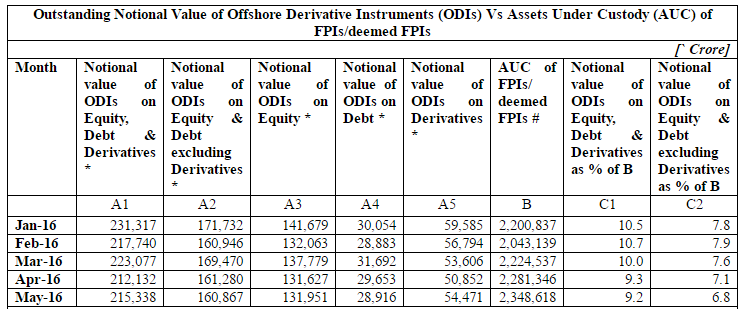

The data showed that there has been a constant decline in investment in P-Notes (including equity, debt and derivatives market) starting from January 2016. P-Notes stood at 10% range for almost three months from Jan-March, 2016. This has now even dropped to 9.2% in May 2016 to Rs. 2.15 trillion.

Participatory notes investments fall to 30-month low at 2 lakh crore in October

Participatory notes investments fall to 30-month low at 2 lakh crore in October P-Notes investment hits 5-month high at Rs 2 lakh crore in August

P-Notes investment hits 5-month high at Rs 2 lakh crore in August Sebi tweaks ODI rules; this is how it will affect you

Sebi tweaks ODI rules; this is how it will affect you