Is income tax filing deadline going to be extended?

Many taxpayers are facing hard times in filing their Income Tax Returns they have been requesting IT-department to extend the deadline.

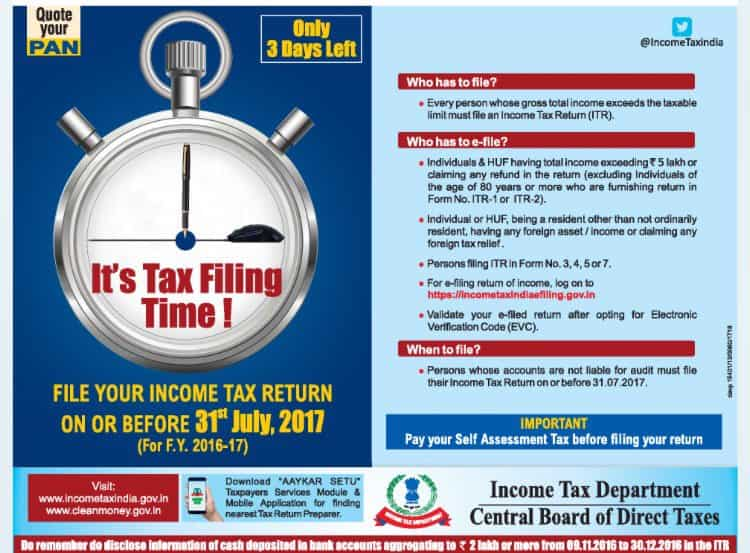

Key Highlights:

- ITR filing deadline at July 31 every year

- Citizen tweeting @IncomeTaxIndia with their queries and asking to extend the deadline

- CBDT says file your income tax return on or before July 31, 2017

Deadline for filing income tax return (ITR) is just a day away, and taxpayers are already finding it difficult to do so.

The last date for filing is ITR is generally scheduled at July 31 of every year. Now that only one day is left there has been massive rush on every portal sanctioned by the Income Tax Department that many citizen have been tweeting with @IncomeTaxIndia with their queries and asking to extend the deadline.

And as you start filing your returns, the @IncomeTaxIndia India website goes down!! Showing #ServiceUnavailable #incometax #Brilliant

— Sulabh Puri (@sulabhpuri) July 29, 2017

#incometax website is down due to heavy traffic, it happens every year in last days, why can't we improve IT systems.

— CA. Kushal Soni (@CAKushalSoni) July 29, 2017

#Incometax site stopped working totally. @PMOIndia @narendramodi @arunjaitley @FinMinIndia @IncomeTaxIndia pic.twitter.com/GyrTKW1ll1

— Abhijit Roy (@aroymail) July 29, 2017

Income tax filing website down! What can the common man do? #incometax pic.twitter.com/E7GV2VYTR1

— Swagatam Banerjee (@swagatamb) July 27, 2017

@IncomeTaxIndia @FinMinIndia

Sir#IncomeTax eFiling is down from y'day how can we expect to meet the deadline when infra is not upto mark— Raghu Kashyap (@casdraghu) July 29, 2017

There were many reports earlier mentioning that the due date for filing ITR might be extended. However, on July 29, the Central Board of Direct Taxes (CBDT) issued a notification saying, ''File your income tax return on or before July 31, 2017 for FY17.”

In the notification it was stated that every person whose gross total income exceeds the taxable limit must file for Income Tax Return. Also person whose accounts are not liable for audit must file their ITR before July 31, 2017.

Still, many media reports suggest that there are possibility for extension in the ITR deadline due to various changes brought in during the fiscal year 2016-17.

One of the reason was the extension given by the CBDT in filing the Tax Deducted at Source (TDS) returns by banks – who issue the Form 16 (TDS certificate) to employees. Earlier the deadline was extended from May 15, 2017 to May 31, 2017 and then went up till June 15, 2017.

For an salaried individual, TDS certificate is among very important document which helps them to understand - how much of salary income have been received, deduction the employee availed and taxes that have been deducted during the fiscal.

According to section 203 – the IT-Act, 1961, an employer is required to issue Form 16 to the employees revealing the total TDS on income.

Another reason would be the linking of PAN with Aadhaar for ITR- filing. The government in a notification on June 28 said 12-digit biometric Aadhaar or the enrolment ID is a must at the time of application of permanent account number (PAN).

Amendments were made in sub-rules 5 and 6 of Rule 114 related to Aadhaar. Such led to problems like e-filing website crashing, mismatch in information needed for linking PAN with Aadhaar and many more.

Also, the long-awaited Goods and Services Tax which came into effect from July 1, have resulted in many chartered accountants bring busy helping clients shift to the new regime.

This created another shortage in tax advisors for guiding employees with filing ITRs.

To make it easy for taxpayers, the Finance Minister Arun Jaitley on July 11,2017 had launched a new service module 'Aaykar Setu' in order to make income tax filing process more simpler.

According to Ministry of Finance, the application is an e-initiative that will help taxpayer in reducing the direct physical interface between assesses and tax assessing authorities.

Eligible for ITR filing

Individual & Hindu Undivided Family (HUF) having total income exceeding Rs 5 lakh or claiming any refund in the return (excluding individuals of the age of 80 years or more who are furnishing return in Form No ITR - 1 or ITR-2).

Individuals and HUF being a resident other than not ordinarilly resident, having any foreign asset/income or claiming any foreign tax relief.

Persons filing ITR in Form No 3,4,5 or 7

ALSO READ:

12:52 PM IST

Income Tax Alert! Filing ITR online? Ensure e-verification before logging out; step by step guide

Income Tax Alert! Filing ITR online? Ensure e-verification before logging out; step by step guide Alert! Three Month Tax Saving Exercise: PPF, loans, insurance to education, top investment options for taxpayers

Alert! Three Month Tax Saving Exercise: PPF, loans, insurance to education, top investment options for taxpayers  Planning to opt for new income tax slabs 2020? You can still claim this NPS account benefit

Planning to opt for new income tax slabs 2020? You can still claim this NPS account benefit Changes required in Income Tax law to benefit homebuyers; check what experts think

Changes required in Income Tax law to benefit homebuyers; check what experts think Yet again, Finance Minister pays heed to Zee Business Managing Editor Anil Singhvi's call, extends ITR filing deadline

Yet again, Finance Minister pays heed to Zee Business Managing Editor Anil Singhvi's call, extends ITR filing deadline