Narendra Modi win in General Elections 2019 already factored-in; here are key stocks you should invest in now

A rural stimulus pre-elections is a key discussion point among investors. The UBS report said that the government may consider various stimulus options to support the rural economy in the run-up to Lok Sabha elections next year.

Global investors have already factored in PM Narendra Modi's victory in the Lok Sabha elections, said global brokerage UBS Securities. However, going by how things transpired in Karnataka Elections after BJP emerged the largest party, market still needs more data points to exactly predict general election outcome. Arithmetic can be more powerful than the narrative in Indian politics, said UBS.

"Our discussions with investors suggest that they presume Modi will win 2019 national elections. Market's recent performance and valuation multiples also suggest that this is priced in. In our view, opposition alliances will be a key element to track given fragmented votes and first-past-the-post system in India," said the brokerage.

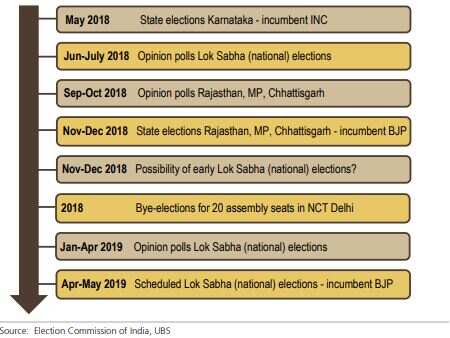

"Investors should track potential development of alliances of opposition parties in the run-up to 2019 elections. Three large state elections due in end-2018 and any opinion polls over the next few months will be the next pointers for market sentiment," it added.

A rural stimulus pre-elections is a key discussion point among investors. The UBS report said that the government may consider various stimulus options to support the rural economy in the run-up to Lok Sabha elections next year.

"There are a number of ways to drive rural stimulus, for example, higher minimum support prices (MSPs), compensating farmers for the difference between MSPs and actual selling prices like done in the state of Madhya Pradesh, direct lump sum payments like in the state of Telangana and loan waivers."

Upcoming political events:

These will result into varying implications for macro, sectors and stocks, the UBS report pointed out.

The report further noted that though the first 3-3.5 years of the Modi government saw a number of reforms and politically tough steps like demonetisation, GST implementation, bankruptcy code, the run-up to elections is unlikely to see any big bang measures.

The government's political economy stance into the elections will be a key driver of sector/stock relative performance and rural-exposed stocks should continue to do well, irrespective of whether the rural/agri tilt is "real or just rhetoric".

WATCH ZEE BUSINESS VIDEO HERE

Hero MotoCorp, Shriram Transport Finance, Ujjivan Financial Services, Dalmia Bharat, Emami and Marico are UBS' preferred picks among rural stock. UBS remains Overweight on IT services, retail and corporate private banks with strong retail deposit franchises and niche nonbank financials.

The report however noted that any major populism/stimulus would likely drive bond yields higher and possibly hurt the currency.

"We remain neutral on State-owned banks (SOE) banks. Our end-2018 Nifty base/ upside/downside scenarios of 10,500/11,900/8,800 imply an unattractive risk-reward for the market overall," the report said.

On job creation, the report said, the pace of job creation will increase if the government's policy push is successful.

12:43 PM IST

Narendra Modi Yoga videos: PM shares 3D animated videos on Twitter

Narendra Modi Yoga videos: PM shares 3D animated videos on Twitter Yoga With Modi YouTube Videos Playlist: Want to know how he remains so fit? Here is the open secret

Yoga With Modi YouTube Videos Playlist: Want to know how he remains so fit? Here is the open secret Mann Ki Baat: 'Seek forgiveness for imposing coronavirus lockdown' - What all PM Narendra Modi said

Mann Ki Baat: 'Seek forgiveness for imposing coronavirus lockdown' - What all PM Narendra Modi said  Coronavirus: Proud moment! Twinkle Khanna reveals story behind Akshay Kumar's Rs 25 cr donation

Coronavirus: Proud moment! Twinkle Khanna reveals story behind Akshay Kumar's Rs 25 cr donation #IndiaFightsCorona: Paytm to donate Rs 500 crores; takes this amazing initiative - PM Narendra Modi lauds it

#IndiaFightsCorona: Paytm to donate Rs 500 crores; takes this amazing initiative - PM Narendra Modi lauds it