RBI August bi-monthly monetary policy: Is “No Rate Cut” a possibility?

Analysts expect a rate cut in the RBI's August bi-monthly monetary policy, however there were list of several factors that indicated cautious stance in the meet. Policy repo rate for now stands at 6.25%.

Key Highlights:

- RBI kept repo rate unchanged in June policy

- CPI and WPI inflation below 1.5% currently

- Policy repo rate stands at 6.25%

The Reserve Bank of India (RBI) and Monetary Policy Committee (MPC) will announce its August bi-monthly monetary policy on August 2, 2017.

While one could talk about several factors supporting a repo rate cut in the bank's monetary policy, let's consider if there is any probability for a status quo.

At present, the policy repo rate under liquidity adjustment facility (LAF) stands at 6.25%.

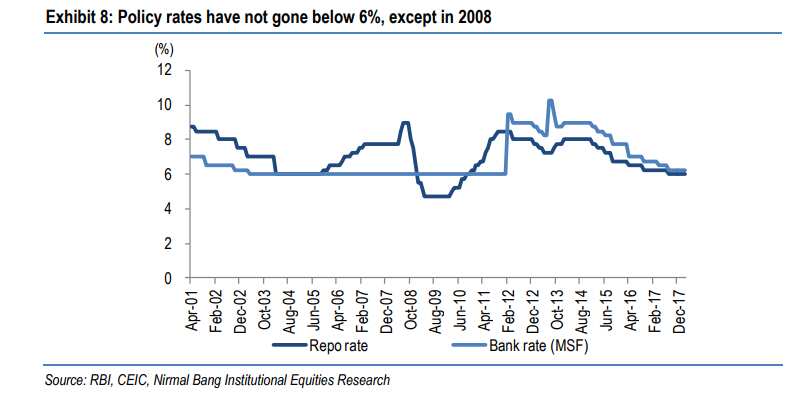

The only time when benchmark interest rate was seen below 6% was between January 2009 and August 2010 following the 2008 global financial crisis.

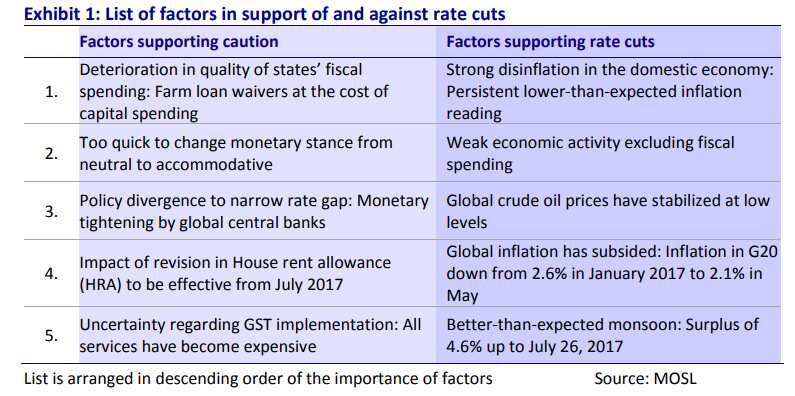

According to Motilal Oswal, just like there are several factors supporting the case for rate cut – there are also equal number factors that are demanding caution and are equally relevant and valid too.

Policy decisions are said to be usually forward looking and inflation ahead is seen under pressure from increase in house rent allowance under 7th Pay Commission, upturn in food prices especially vegetables, formalisation effect of Goods and Services Tax (GST), increase in rural wages and minimum support (MSP) for crops and farm loan waivers.

Nikhil Gupta and Rahul Agrawal of Motilal Oswal said, "None of the arguments might appear new. The eventual decision would depend on the weights assigned to these factors. To our mind, the right-hand side – factors supporting rate cut – is heavier than the left-hand side, making us a proponent of a sharper-than-consensus rate cut.”

However, as per HSBC, the above mentioned factors are temporary and inflation would be still near 4% in the coming month which is under check with the government and RBI's inflation target.

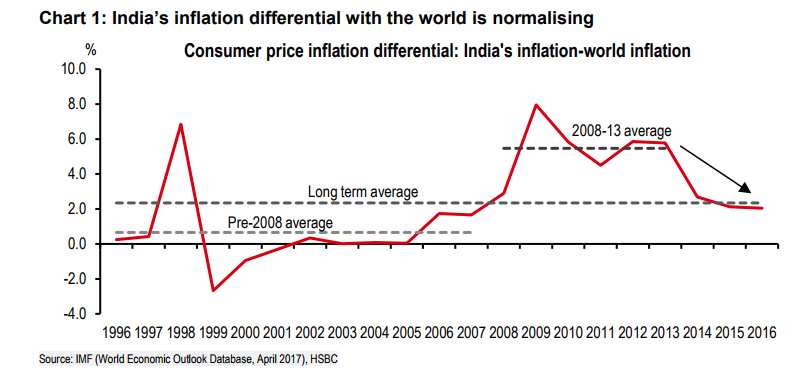

Long-term inflation differential between India and the world is close to 2% right now compared to over 5% in the 2008 – 2013.

Economists at HSBC said, “The factors that caused it have reversed and India's inflation differential may well be getting back to the pre-2008 levels, suggesting domestic inflation could be under 4.5% over the next few years.”

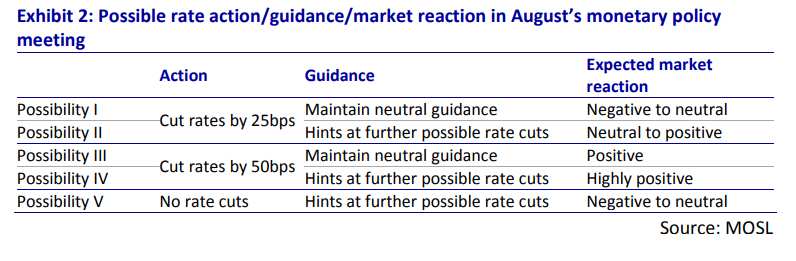

As per HSBC, If the RBI was a pure inflation targeter, it would mean no rate cuts (or hikes) since the target is perfectly met. While if it was a real rates targeter and wanted to lower real rates to, say, 1.5% (where it was for much of the last two years), it could cut rates by about 75bps."

But HSBC further added, “In reality, the RBI is not a real rates targeter and has recently mentioned that its tolerance for slightly higher real rates is justified during periods of financial impairment. As such we stick to our forecast at the lower end of the rate cut possibility range. We expect the RBI to cut the policy repo rate by 25bps on 2 August to bring it down to 6%.”

Estimating a 50% chance of rate cut by RBI, Teresa John, analyst at Nirmal Bang said, "We believe it will be a close call, given the differences in views within the MPC. If the RBI waits till October 2017, the probability of a rate cut falls to 20%, as global factors including gradual reduction in the balance sheet by the US Federal Reserve may also come in the way of the RBI."

Moreover, if the RBI refrains from cutting rates in response to the soft patch of inflation, Teresa believes it will also be able to push back a rate hike as inflation rises.

Motilal Oswal report said, "We believe that the RBI has sufficient room to cut policy rates by 50bp and stick with its neutral guidance. However, the ghosts of past stance and the challenge of a simultaneous change in the mindset of three committee members might postpone the rate cut to October. In any case, a 50bp rate cut is imminent."

ALSO READ:

08:36 AM IST

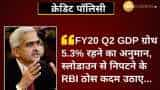

RBI Monetary Policy December 2019: Surprise! No change in benchmark lending rate, repo still stands at 5.15 pc

RBI Monetary Policy December 2019: Surprise! No change in benchmark lending rate, repo still stands at 5.15 pc RBI cuts repo rates, Shaktikanata Das says, "Central bank will retain its accommodative stance"

RBI cuts repo rates, Shaktikanata Das says, "Central bank will retain its accommodative stance" RBI Monetary Policy October 2019: KEY TAKEAWAYS from fourth bi-monthly statement

RBI Monetary Policy October 2019: KEY TAKEAWAYS from fourth bi-monthly statement RBI policy announcement: Zee Business poll favours 0.25% rate cut

RBI policy announcement: Zee Business poll favours 0.25% rate cut  CPI numbers tomorrow! Food, beverage, LPG prices, gold to play this major role

CPI numbers tomorrow! Food, beverage, LPG prices, gold to play this major role