RITES IPO sees 23% subscription in few hours of opening; is it worth subscribing?

The issue, which opened at 10 am today, has received bids of 57,39,600 equity shares which would be 23% of the total IPO up till 1338 hours, as per data given on NSE.

RITES Ltd, a wholly owned government company, on Wednesday launched its initial public offering (IPO) by offering somewhat 2.52 crore equity shares. Through this IPO, government is planning to sell about 12.6% of its share capital in the company. Investors can subscribe this IPO till June 22. Apart from its core objective of providing consultancy services in rail transport management to operators in India and abroad, RITES has diversified into planning and consulting services for other infrastructure, including airports, ports and highways etc. The issue which opened at 10 am today has till 1338 hours received bids of 57,39,600 equity shares which would be 23% of the total IPO, as per data given on NSE.

Price band of this IPO is fixed at lower end of Rs 180 per piece and upper end of Rs 185 per piece. Discount of Rs 6 per share is given to eligible employees and retail individual investors.

Objective of this IPO is to carry out the disinvestment of 24,000,000 Equity Shares held by the Selling Shareholder in the Company, equivalent to 12% of the issued. Also to enjoy the benefit listing the equity shares on the stock exchanges.

Through this IPO, the company plans to raise in the range of Rs 453.60 crore to Rs 466.20 crore.

50% of the issue is offered to Qualified Institutional Buyer (QIB), while 35% was given to retain individual investors (RII) and remaining 15% were kept to non-institutional investors.

Book Running Lead Manager (BLRM) for this IPO were companies like Elara Capital (India) Private Limited, IDBI Capital Markets & Securities Limited, IDFC Bank Limited and SBI Capital Markets Limited.

Analysts are very optimistic on this IPO, however, Reliance Securities has highlighted a list of factors that need to be remembered while investing in the RITES issue.

Pros

- Wide range of consultancy services and a diversified sector portfolio in transport infrastructure space.

- Strong order book of Rs 48.2bn (3.6x FY17 revenue)

- Preferred consultancy organisation of the Government of India including Indian Railways.

- Large order book with diversified clientele base across sectors. Consistent financial performance aided by robust internal control and risk management system.

- Strong investment in infrastructure and expanding international operations

Cons

- Over dependence on Railway orders, any slowdown in Railway capex may impact order inflow and revenue.

- Slowdown in capex in infrastructure and energy sector.

- Any change in government policies or funding agencies for lines of credit.

- Aggressive bidding by existing or new player.

- Should you invest?

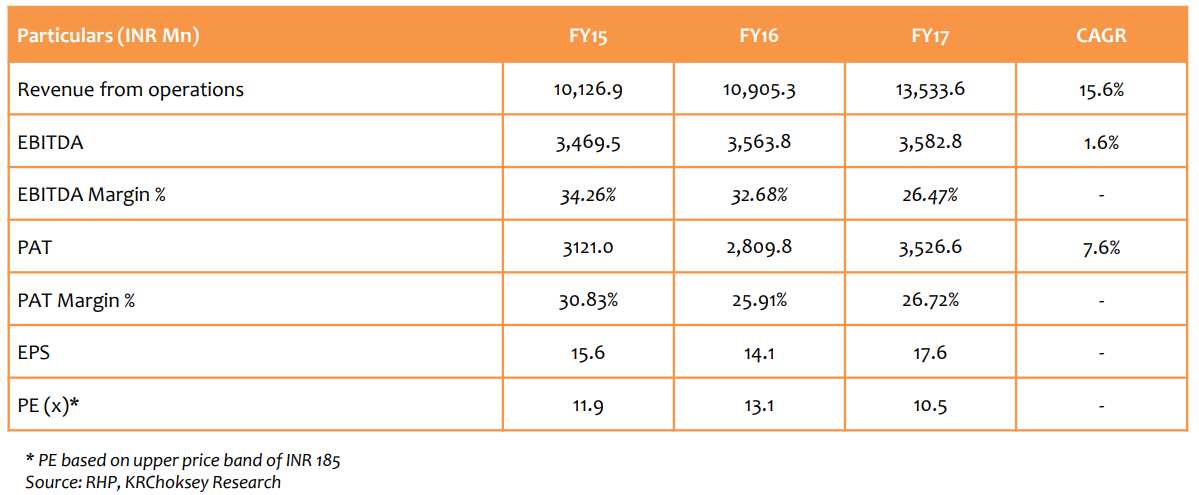

Arafat Saiyed and Rupesh Sankhe, Research Analysts at Reliance Securities, said, “RITES’ revenue and PAT clocked 7% and 9% CAGR, respectively over FY14-17, while margin expanded to 32.0% in FY17 from 22.7% in FY14. Notably, RITES paid an average dividend of 27% during the same period. Further, with total cash of Rs25bn, RITES enjoys a robust liquidity.”

“Assuming moderate revenue growth of 10% CAGR through FY17-20E, the Company is valued at 8.6x FY20E earnings, which appears to be justified considering its unique business model, steady growth and healthy return ratios. Hence, we recommend SUBSCRIBE to the Issue,” the duo added.

Dhavan Shah, Rajil Shah and Neha Raichura, analysts at KR Choksey said, “In terms of valuations, at upper price band of INR 185, the stock is valued at 11.4x on annualized FY18 earnings. We believe the valuations are reasonable primarily on account of large C&I on books to the tune of INR 14bn. Given the post issue MCAP will be INR 37bn with negative net debt of INR 13.1bn, EV stands at around INR 23.9bn.”

The trio explains, RITES management is upbeat to execute INR 48bn worth of contracts in next 2-3 years and hence we expect the revenues could grow at least at 20% CAGR against ~7% CAGR in past. Further, assuming OPM & NPM could remain at 30% & 24% respectively. The company could make EBITDA & PAT of at least INR 4.5bn and INR 3.6bn respectively in FY19. This could translate into EV/EBITDA of ~5.3x & PE of ~10.3x. Valuations are attractive looking at the order backlog and orders visibility from railways. Thus, we recommend ‘SUBSCRIBE’ rating on the issue.

Post issue, RITES market capitalisation can reach up to Rs 3700 crore at upper price band.

01:54 PM IST

Railways PSU RITES offer-for-sale (OFS) opens on bourses; share price slumps 5 pct

Railways PSU RITES offer-for-sale (OFS) opens on bourses; share price slumps 5 pct Budget 2020 My Pick: RITES share can give you windfall returns, likely to benefit from budget

Budget 2020 My Pick: RITES share can give you windfall returns, likely to benefit from budget Stocks in Focus on November 22: CSB bank, RITES to BHEL; here are the 5 Newsmakers of the Day

Stocks in Focus on November 22: CSB bank, RITES to BHEL; here are the 5 Newsmakers of the Day RITES Order Book stood at Rs 5,800 crore at end of Q2: Rajeev Mehrotra, CMD

RITES Order Book stood at Rs 5,800 crore at end of Q2: Rajeev Mehrotra, CMD Damdar Diwali: Top picks to buy on an auspicious day - Check the full list of suggested stocks

Damdar Diwali: Top picks to buy on an auspicious day - Check the full list of suggested stocks