Rupee at all-time low; The currency's free fall may impact your EMIs on home, personal and education loan; here’s how

The rupee has now depreciated by 6.2% since June 2018 when the RBI started hiking rates. Now it needs to be noted that, Indian rupee in free fall is not a good sign for the country for a lot of reason.

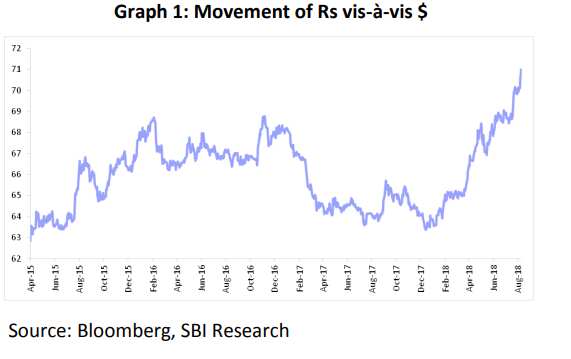

Indian rupee has reached to a level never witnessed before against US benchmark dollar index. Today, the domestic currency touched an all-time low of 71.895 before ending at 71.665 above 0.45% against US dollar. Since the start of 2018, Indian rupee has been among worst performing currency in Emerging Market (EM). The rupee has now depreciated by 6.2% since June 2018 when the RBI started hiking rates. Now it needs to be noted that, Indian rupee in free fall is not a good sign for the country for a lot of reason. The depreciating rupee adds inflationary pressures further, because imports become costlier and therefore increasing the prices of key commodities such as oil, imported coal, minerals, and metals. Interestingly these are not the only factors will face brunt of Indian rupee in free fall, guess what! You will also be impacted especially when you opt for home, personal and vehicle loans.

Anindya Banerjee analysts at Kotak Institutional Equities says, for five years Dollar Rupee struggled to score a fresh all time high above 69. Last two months, scenario has flipped on its head. The pair is now printing record highs with absolute ease. So strong is the uptrend, that yesterday the pair refused to trade within the daily price range of Monday. It closed at a life high of 71.57 on spot.

According to Banerjee now tables have for the USDINR pair.

For emerging market currencies, liquidity vanishes once the pair enters a strong trend. In 2017 it was the turn of Rupee bulls to go on a rampage. This time, the dollar bulls are on a similar path. Last year, importer demand for dollar vanished; this year exporters are turning their back.

In such situations, Banerjee says, “unless RBI intervenes, speculators along with distressed buyers or sellers of Dollars, can take prices too far too fast.”

HDFC Bank says, “The threshold limit (for the intervention) has increased from 69 levels a month back to around 70.6 now. For one, after spending around USD 25 bn on intervention, the pace of intervention has slowed down. Two the comments of some policy officials seem to suggest that the government seem to be okay with the ongoing depreciation.”

Explaining many reasons on what can be done if currency depreciation pressures persist, the economists at HDFC Bank says that RBI could consider hiking rates and tightening liquidity with an emergency MPC meet.

Now if a rate hike dilemma once again emerges for RBI in the upcoming policy on the back of weak Indian rupee, inflationary pressure and liquidity surplus, then bad days have arrived for you in terms of your borrowing.

Policy repo rate is already at 2-year high of 6.50% in India. Repo rate is a rate at which banks borrow money from the RBI in case they have shortage of funds. RBI decides to hike repo rate in order to control money supply, level of inflation and liquidity in the country.

Each lending and deposit rates decided by any bank has a direct relationship with policy repo rate.

When banks borrow funds from the central bank during shortage, they will now pay higher interest rate which is 6.50% this was not the case two policy ago as they just paid 6% till June 2018. So now with a 50 basis points hike borrowing from RBI becomes costly for banks.

Another reason to hike lending rate would also be corporate bonds. When rupee depreciates the corporate bonds are kept at higher level which can force in hike of interest rate which would tackle the fall by attracting foreign capital. However, such would affect the long term debt funds as their Net Asset Value (NAV) returns could drop when interest rates surge. This will hurt borrowers as the cost of borrowing gets expensive.

Recently, a Moody’s Investor Service report mentioned that Indian central bank’s efforts to tighten the availability of rupees in the market and halt a slide in the currency may squeeze profitability at the nation’s lenders as it raises their funding costs.

In ICRA’s view, Banks having large investments in corporate bonds will see a further erosion in profits if yields surge following measures by the RBI to curtail currency volatility.

If RBI intervenes by shortening the availability of local currency this will worsen the liquidity of banking system which is already in cash shortage.

According to the Bloomberg Economics India Banking Liquidity Index, liquidity in the financial system is currently at a deficit of around 215.7 billion rupees ($3.14 billion), having moved from a surplus of 5.5 trillion rupees in March 2017.

From the above, this would mean RBI would charge a higher interest rate for all money given out to scheduled commercial banks (SCB).

If a bank is paying higher interest rate to RBI, this will leave no option for them but to charge customers with higher lending interest rate especially when it comes to home and auto loans.

Hence, borrowing cost on home loans, auto loans, personal loans and gold loans would rise further.

In case if you have taken loan for studies in overseas countries, than it is bad for you when rupee is in free falls.

For example, if you have taken a loan of $40,000, and you paid your first installment of $10,000 at Rs 64 per US dollar, then your total cost will be Rs 6.40 lakh. However, in current scenario where rupee has inched near $69, then your second or third installment of $10,000 would cost you Rs 6.90 lakh.

Loans are the major income for banks, and higher lending rates would slow down business of banking system which will impact their earnings in book.

On September 01, the country's largest lender State Bank of India has already increased its benchmark lending rates or MCLR by 0.2 per cent, effective from today. Other banks are expected to follow the move.

SBI has increased the lending rate by 20 basis points across all tenors up to three years.

06:20 PM IST

Rupee vs dollar in times of coronavirus: INR slips 32 paise to 75.21 amid scare

Rupee vs dollar in times of coronavirus: INR slips 32 paise to 75.21 amid scare Rupee in times of coronavirus mahamari: INR rises 56 paise against US dollar to 74.60 in early trade

Rupee in times of coronavirus mahamari: INR rises 56 paise against US dollar to 74.60 in early trade Rupee rises 18 paise to 76.02 against US dollar in early trade

Rupee rises 18 paise to 76.02 against US dollar in early trade Rupee weakens to record low; breaches 76 mark

Rupee weakens to record low; breaches 76 mark Rupee vs dollar: INR tanks 95 paise, falls below 76 level against US dollar

Rupee vs dollar: INR tanks 95 paise, falls below 76 level against US dollar