Samvat 2074: Sensex, Nifty to give double-digit growth?

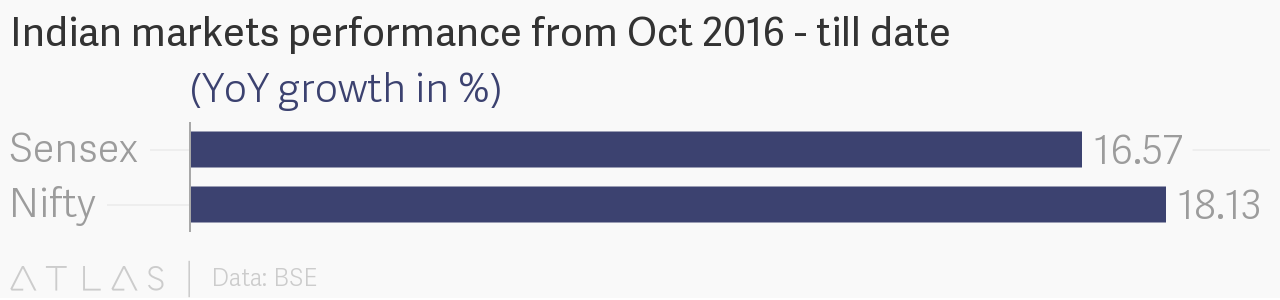

Samvat 2073 was a great year for Indian markets adding over Rs 25 lakh crore to investor's portfolio. From the past-samvat, Sensex and Nifty has grown by 16% and 18% respectively.

A special 'Mahurat' trading session was held on Thursday to commence the start of the Hindu New Year – Samvat 2074. The trading will be held betweem 6.30 pm to 7.30 pm.

Samvat 2073 was a great year for Indian markets adding over Rs 25 lakh crore to investor's portfolio. However, this year involved many key changes with inception of demonetisation drive, rollout of a landmark tax reform Goods and Services Tax (GST) and Nifty reaching over 10,000-mark.

From the past-samvat, key Indian equity indices have been on a bull-run shrugging off all political and global uncertainties.

From October 2016 – till date, the benchmark Sensex has grown by 4,648.98 points or 16.57% and recorded a high of 32,670-mark. While the benchmark Nifty 50 surged over 1,573.95 points or 18.13% and touched a new high of 10,252-level.

In the month of October 2016, the 31-scrip index and the 51-scrip index were trading near 28,000-mark and below 9,000-level respectively.

The pace of domestic market for this Diwali and till next year looks very good.

Dipan Mehta, member of BSE, NSE said,"From previous Diwali, we have seen nearly 18% return, so definitely this year also we are seeing same robust performance."

This year looks a year of rally as Nifty Small Cap index rallied ~21.5% higher than returns generated by Nifty Midacap and Nifty 50; continuous domestic flows in face of FII’s selling – YTD average of Equity inflows of Rs 22,500 crore.

On valuation front, Nifty is trading at P/E of 19X, 16X and 14.5X of FY18E, FY19E and FY20E earnings respectively.

Mehta said, “I think we are in for a very exciting times and upswing in earnings have just begun after two-three years of very flattish performance. So i think, this will be a great year in variety as risk involved either in form of technical, political or global have become less at the moment. We say that, Indian markets are trading in a blue sky scenario - which looks very good for next few months also.”

He added, investors can expect 12-15% return from Sensex and Nifty this Diwali. Individual stocks may even more returns than stock exchanges, if the portfolio is invested in correct stocks and correct sectors.

While, Sanjiv Bhasin from IIFL said, "This Diwali has been very good and share market has moved in one direction. We believe India's earnings and macro-economic condition will remain weak.

He stated that due to benign liquidity condition, markets are right now in overbought and overstress areas. By next year definitely market will be in positive trajectory but in within next five-six months we believe correction of 5-7% would be seen as complicency is high - but this will again be an opportunity for longer-term buying option.

From this Diwali to next year, we believe Sensex and Nifty would definitely see a rally of 8 - 10%.

According to Mehta, service sector automatically does very well in India. Currently, it is growing at higher rate than the average GDP - and from agriculture and manufacture sectors, the service sector is growing at faster pace. This business can grow at 15-20% easily for next two-three years.

Even education sector looks positive in coming years.

Abhinav Gupta, Vice President, Share India Securities in Aaryana Matasco report said, “We believe that best is yet to come for Indian markets. India’s economy, will regain its course to grow at 7-8% after faltering slightly over the past 4 quarters. As familiarity of GST kick in, capacity utilization will increase leading to improvement in corporate earnings and higher private capex. Nifty’s earning are likely to grow at CAGR of 18% – 20% over FY17-FY20E period.”

He added,” While in the near term, we expect markets to be range bound driven by global factors, fund flows, IPO market and sentiment; in long term Indian equity market is in midst of structural bull run and portfolio of right stocks will create significant long term wealth.”

Investment picks for this year are seen in companies which have completed significant capex and are expected to witness higher utilization levels; increase in financial saving of households, increased government spending on infrastructure development and defence, higher commodity prices and shift in market share to organised companies.

As per Share India, companies like Indian Oil Corporation,Larsen & Toubro, Tata Steel, Sundaramfast,Cyient, MOIL, Trident, Granules, Mahaseamles, IGPL, Asian Granito and Pennar Industries will outperform.

06:47 PM IST

Diwali Mahurat tradings: Here's a list of top performers

Diwali Mahurat tradings: Here's a list of top performers