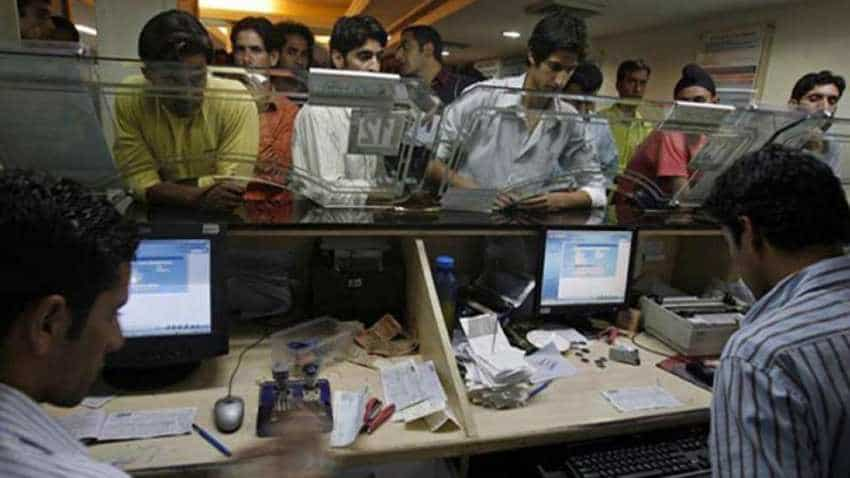

UPI 2.0 launched: Massive benefits for bank customers available now

Until now UPI could be linked only to savings bank accounts. In the new version, it can be linked to current accounts as well. The other features offer benefits to both individual customers as well as merchants in terms of enhanced security.

The National Payments Corporation of India (NPCI) launched the Unified Payments Interface (UPI) 2.0, with features such as overdraft facility, one-time mandate, invoice and signed QR, said a press release issued by NPCI.

The service was launched by Reserve Bank of India (RBI) governor Urjit Patel along with other senior officials from NPCI and the banking industry.

Until now UPI could be linked only to savings bank accounts. In the new version, it can be linked to current accounts as well. The other features offer benefits to both individual customers as well as merchants in terms of enhanced security.

Delivering the presidential address, the governor spoke about the need for ensuring adequate importance to be ascribed to cybersecurity, stating that all efforts need to be channelled to this area and that costs should not be an inhibiting factor to this critical area.

The overdraft facility will enable customers to link their overdraft accounts to the UPI app and transact instantly. All benefits with an overdraft account will be available to users.

WATCH ZEE BUSINESS VIDEO HERE

Akhil Handa, head - fintech and new business initiatives, Bank of Baroda, said, “The linking of overdraft will help the flow of credit with ease based on transaction history, combined with a one-time mandate can throw up many innovative use cases. Further, the invoice in inbox feature will lead to standardisation of invoices and will offer better checks before committing a payment. The limit enhancement from Rs 1 lakh to Rs 2 lakh will also offer scope to enhance the ambit of payments that can be made through UPI. However, the standing mandate instruction is much required. Hopefully, the regulator will observe the risk associated and take a call on it.”

Mandates can be created and executed instantly. On the date of actual purchase, the amount will be deducted and received by the merchant / individual user.

10:08 AM IST

Yes Bank crisis: Do online transactions? Alert! Swiggy, Flipkart, others scrap UPI payments option

Yes Bank crisis: Do online transactions? Alert! Swiggy, Flipkart, others scrap UPI payments option UPI user in Noida loses Rs 6.8 lakh from SBI account: Why it happened and how to avoid such fraud

UPI user in Noida loses Rs 6.8 lakh from SBI account: Why it happened and how to avoid such fraud Ex-NPCI MD Abhay Hota joins Indiabulls Ventures as Independent Director

Ex-NPCI MD Abhay Hota joins Indiabulls Ventures as Independent Director WhatsApp vs Paytm: Govt body asks WhatsApp to follow guidelines

WhatsApp vs Paytm: Govt body asks WhatsApp to follow guidelines Samsung Pay now available on UPI; collaborates with Axis Bank

Samsung Pay now available on UPI; collaborates with Axis Bank