Mutual Fund industry soars by 42% in FY17; find out best performers

According to Amfi, the industry added about 6.2 lakh systematic investment plan accounts every month on an average during the year (till February), with an average ticket size of Rs 3,100 per account.

On Mutual Fund industry has witnessed robust growth in the last financial year. The assets under management (AUM) of the mutual fund (MF) industry saw an exceptional growth of 42% at Rs 17.5 trillion in fiscal 2017 from Rs 12.3 trillion a year ago, a report said.

According to the report by ICRA, the quarterly average assets under management also registered a quarter-on-quarter growth of 8% in the March quarter.

Net inflows in liquid, income and equity (including equity linked savings schemes or ELSS) categories saw fresh investment of Rs 1.2 trillion, Rs 96,000 crore and Rs 70,000 crore respectively, Icra said.

Mutual Funds have been proved as the most successful and secure investment tool. One of the reasons which has made it popular is that it helps in saving tax. Tax Saving Mutual Fund scheme, also known as Equity Linked Savings Schemes or ELSS, are offered by most Asset Management Companies in India.

According to a PTI report, in fiscal 2017, the total inflow into the category stood at Rs 70,367 crore with net inflows in every month.

According to Amfi, the industry added about 6.2 lakh systematic investment plan accounts every month on an average during the year (till February), with an average ticket size of Rs 3,100 per account.

In the year gone by, the industry added 77.4 lakh new folios, or around 6.4 lakh new folios every month, despite volatility in the overall market conditions, the report said.

March saw the highest number of folios added in a month in the entire fiscal at 10.1 lakh. The growth was driven by the ELSS category that added 3.2 lakh folios in the month.

Out of the 10.1 lakh folios, 7.4 lakh came from the equity (including the ELSS) category. The folio count for the liquid category more than doubled in the year, suggesting that retail investors are looking at this route for surplus cash deposit, the report said.

Here's a look at top Mutual fund performers under different categories. The data has been shared Quant GWM, Mutual Fund Advisory, as on April 10, 2017.

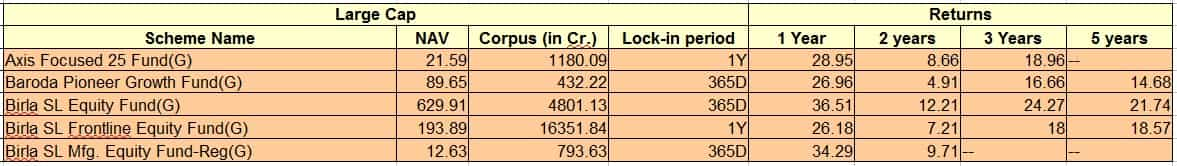

1. Large cap:

As per the data, the topmost in the list is Axis Focused 25 Fund (G) with Net Asset Value (NAV) of 21.59 and corpus size is Rs 1180.09 crore. With the lock-in period of one year, the fund gave return of 28.95% in one year, 8.66% in two years and 18.96% in three years.

Second is Baroda Pioneer Growth Fund(G) with NAV of 89.65 and corpus size of Rs 432.22 crore. With the lock-in period of 365 days, the fund gave return of 26.96% in one year, 4.91% in two years, 16.66% in three years and 14.68% in five years.

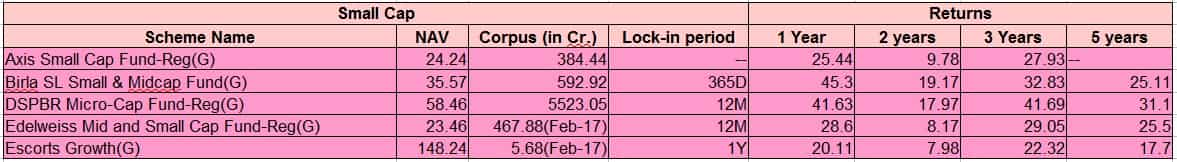

2. Small cap:

As per the data, the top in the list is Axis Small Cap Fund-Reg(G) with NAV of 24.24 and corpus size is Rs 384.44 crore. The Exit load was 3% on or before six months, 2% after six months but on or before 12 months, 1% after 12 months and Nil after 24 months. One year return was 25.44%, 9.78% return in two years and 27.93% return in three years.

Second is Birla SL Small & Midcap Fund(G) with NAV of 35.57 and corpus size is Rs 592.92 crore. With the lock-in period of 365 days and exit load at 1% on or before 365 days, Nil after 365 days. One year return was 45.30%, 19.17% in two years 32.83% in three years and 25.11% in five years.

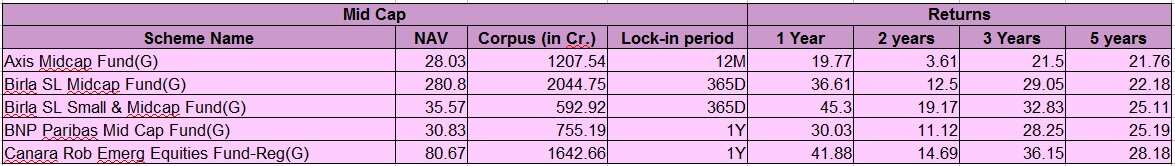

3. Mid cap:

Based on the data, Axis Midcap Fund (G) performed well with NAV of 28.03 and corpus size of Rs 1207.54 crore. With the lock-in period 12 months, the company gave return of 19.77% in one year, 3.61% in two years, 21.50% in three years and 21.76% in five years.

ALSO READ: Tax saving: Mutual Funds should be your next investment option

Second in the list is Birla SL Midcap Fund(G) with NAV of 280.80 and corpus size of Rs 2044.75 crore. With the lock in period of 365 days, the fund gave return of 36.61% in one year, 12.50% in two years, 29.05% in three years and 22.18% in five years.

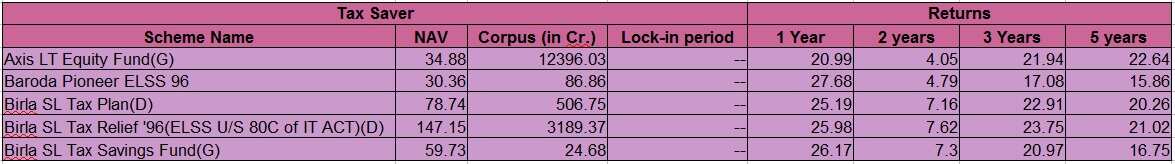

4. Tax Saver:

According to the data, Axis LT Equity Fund (G) with NAV of 34.88 and corpus size of Rs 12,396.03 crore. The fund gave return of 20.99% in one year, 4.05% in two years, 21.94% in three years and 22.64% in five years.

Second in the last is Baroda Pioneer ELSS 96 with NAV of 30.36 and corpus size of Rs 86.63 crore. The fund gave return of 27.68% in one year, 4.79% in two years, 17.08% in three years and 15.86% in five years.

02:20 PM IST

Money Tips For Investors: Zee Business expert reveals strategy to follow

Money Tips For Investors: Zee Business expert reveals strategy to follow Hot Money Tip: How to earn wealth and achieve your financial goals?

Hot Money Tip: How to earn wealth and achieve your financial goals? Money making tip: Which mutual fund is better-suited to achieve long-term investment goal?

Money making tip: Which mutual fund is better-suited to achieve long-term investment goal? Money tip! Direct Fund vs Regular Mutual Fund: Which one will give you more money? Know here

Money tip! Direct Fund vs Regular Mutual Fund: Which one will give you more money? Know here Facing financial crisis? No worries! These investments may bail you out - Here is how

Facing financial crisis? No worries! These investments may bail you out - Here is how