Fixed Deposit: This Post Office Time Deposit scheme comes with income tax saving benefits, 7.8% interest; Should you invest?

Post Office: Time Deposit (TD), or Fixed Deposit (FD), is one of the safest investment options with guaranteed returns.

Post Office: Time Deposit (TD), or Fixed Deposit (FD), is one of the safest investment options with guaranteed returns. Recently, a number of public and private sector banks raised their rates on FDs. However, Post Office TDs continue to remain at par, or even higher than many of the FD plans offered by other banks. As per the official India Post website, a customer can make an investment in four types of TD plans: 1-year, 2-year, 3-year, and 5-year. The interest rates vary from 6.9% to 7.8%.

India Post offers its highest interest rate on five-year TD of 7.8%. This interest rate is higher than the one offered by India's largest lender State Bank of India. If you are looking to grow your money via Fixed Deposit, Post Office arguably is one of the best places to do so. At present, the SBI is providing 6.85% interest on a five-year FD. The rate for this term offered by SBI senior citizens is 7.35 per cent.

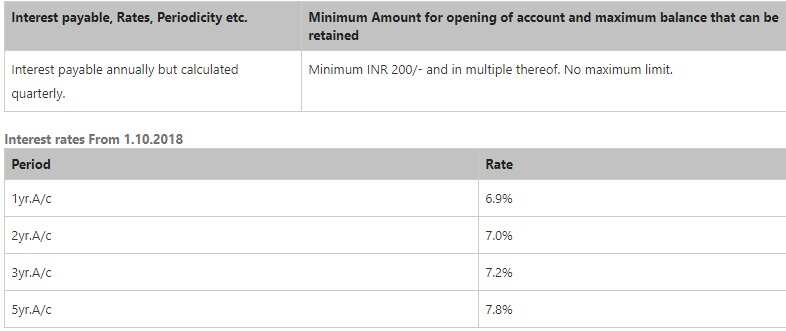

Post Office Time Deposit Interest rate:

*Source; IndiaPost.Gov.In

The interest rate payable on Post Office TD is payable annually but calculated quarterly. One can make a minimum investment of Rs 200. However, there is no maximum limit.

Tax Benefit: Post Office's five-year Time Deposit also qualifies for the benefit of Section 80C of the Income Tax Act, 1961.

Other features:

- Post Office TD can be opened by an individual by cash/cheque. In case of cheque, the date of realization of the cheque in the government account shall be the date of opening of the account.

- Nomination facility is provided to the subscriber at the time of opening and also after an opening of the account. The TD account can be transferred from one post office to another.

- The is no restriction on the number of TDs a customer can open in any post office.

Watch this Zee Business video

- TD account can be opened in the name of a minor and a minor of 10 years and above age can open and operate the account. Two adults can also open joint accounts, while a single account can be converted into Joint and vice versa.

05:27 PM IST

Post Office Savings Bank account holders' alert! Your ATM cards may get blocked after 31st January; Here is why

Post Office Savings Bank account holders' alert! Your ATM cards may get blocked after 31st January; Here is why Post Office account balance: Avoid penalty, know about this new rule

Post Office account balance: Avoid penalty, know about this new rule SBI fixed deposit rates cut by 15 bps? What you can do now

SBI fixed deposit rates cut by 15 bps? What you can do now Income Tax Alert! Top 5 investments solutions that save money for you during ITR filing

Income Tax Alert! Top 5 investments solutions that save money for you during ITR filing SBI fixed deposit rates are a worry for you? Get more money, switch to post office FD, say experts

SBI fixed deposit rates are a worry for you? Get more money, switch to post office FD, say experts