Want to become a crorepati? This top mutual fund tip can help you do that easily

The bid to become a crorepati via investments needs to do one important thing and that is to beat inflation by a big margin during the investment period. To achieve this, experts advise mutual fund investors to take recourse to this SIP trick every year.

Mutual Fund Investment: To answer one's question on how to become rich or how to become a crorepati, an investor should ask from himself or herself what he or she is doing to beat the inflation? According to the investment experts, in long-term perspective inflation has risen to around 6 per cent to 6.5 per cent. In the same period one should expect to generate around 15 per cent returns on one's mutual fund investment, especially if the plan chosen is an equity mutual fund.

Speaking on the returns that a mutual fund investor can expect in long-term, say 30 years, Kartik Jhaveri, Director — Wealth Management at Transcend Consultants said, "In the long-term, say 25 to 30 years, a mutual fund or SIP investor can expect at least 15 per cent returns on one's net money invested. However, it may go up by around 1.5 per cent to 2.5 per cent further, depending upon the performance of the fund manager."

See Zee Business Live TV streaming below:

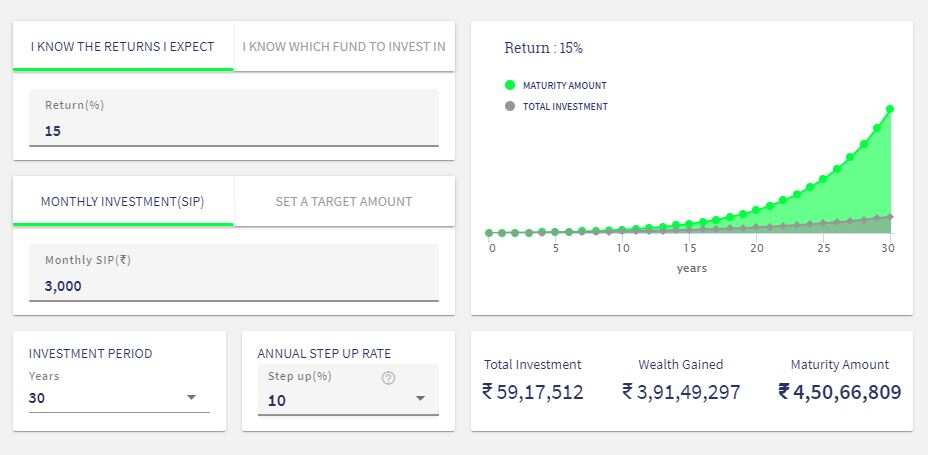

If we assume a minimum 15 per cent returns on mutual funds SIP for the period of 30 years, and if an investor does a mutual fund SIP of Rs 3,000 per month, he or she will get Rs 1,69,82,449 maturity amount. However, here one can must ask a question - after 30 years how much will this Rs 1.69 crore really be worth? To answer this, one needs to know how much inflation will grow in this period as it will eat away a portion of that sum.

Elaborating upon the inflation growth that can be assumed in the period of these 30 years, Balwant Jain, a Mumbai-based tax and investment expert said, "Generally, an investment advisor assumes inflation at around 4 per cent during the period of investment. However, it's better to keep inflation at 6 per cent when an investor is calculating the effect of inflation on one's maturity amount during the investment period." Jain suggested investors assume the rise in inflation at 6 per cent and calculate the increase in the price of the investment goal from the current price to the period of investment. He suggested not to deduct the SIP interest rate and the average inflation rate.

So, how does the mutual fund SIP help beat inflation? Is there any tool available in the mutual fund investment strategy that can help an investor to beat the rise in inflation during the investment period? Yes, there is!

Kartik Jhaveri said that an annual step-up in mutual fund SIP can help an investor beat inflation after the mutual funds maturity period. He suggested that a mutual fund SIP investor should step-up the SIP amount by 10 per cent per annum as in that one year period, inflation would grow around 5 per cent or thereabout. So, if someone has started mutual funds SIP with Rs 3,000, one needs to increase it by 10 per cent or Rs 300 after the completion of one year and this must be increased by 10 per cent every year. If an investor does that, his or her mutual fund SIP of Rs 3,000 per annum for the period of 30 years assuming 15 per cent returns would become Rs 4,50,66,809.

Yes, shockingly, the same SIP would have given Rs 1,69,82449, in case, the investor had not gone for the annual 10 per cent step-up strategy!

Therefore, the annual step-up strategy in the mutual funds SIP would not only help an individual to become a crorepati, but it would also help him or her beat the inflation during this period as well and generate that much more wealth.

08:31 PM IST

Sukanya Yojana: Turn your Rs 6,000 investment into Rs 32.79 lakh; check calculator

Sukanya Yojana: Turn your Rs 6,000 investment into Rs 32.79 lakh; check calculator Turn your Rs 100 per day into Rs 10.72 crore! Here is how to become a crorepati

Turn your Rs 100 per day into Rs 10.72 crore! Here is how to become a crorepati Want to retire rich? Follow this mutual funds investment strategy, say experts

Want to retire rich? Follow this mutual funds investment strategy, say experts Money tips: Don't be misled! Here is what you must not do about mutual funds

Money tips: Don't be misled! Here is what you must not do about mutual funds Want to become rich? This mutual fund can turn your dream into reality; let's find how

Want to become rich? This mutual fund can turn your dream into reality; let's find how