Sebi's diktat leaves 331 suspected shell companies out in the cold

Sebi after when the Ministry of Corporate Affairs (MCA) shared a database of 331 listed shell companies, have asked exchanges to stop trading for this month.

Key Highlights:

- Sebi asks 331 suspected shell companies to stop trading for this month

- Ministry of Corporate Affairs submits data of 331 listed companies

- These 331 listed companies might get delisted

The Securities Exchange and Board of India (Sebi) has asked stock exchanges to halt trading in 331 suspected shell companies for the month of August.

This action came in after when the Ministry of Corporate Affairs (MCA) shared a database of 331 listed companies which are suspected to be shell companies.

Shell Company is an entity without any active business operations or significant assets. They are often created to avoid taxes and many big companies create shell corporations to avoid taxes without attracting legal actions.

Following actions will be taken against these companies.

Firstly, trading in these listed securities will be placed in Stage VI of Graded Surveillance Measures (GSM) with immediate effect. In case, any listed company out of the mentioned list is already under any stage of GSM, it will be moved to GSM VI directly.

Under the Stage VI of GSM, trading in these companies shall be permitted to trade once in a month under trade-to-trade category. Also any upward price movement in these securities shall not be permitted beyond the last traded price and additional surveillance deposit of 200% of trade value shall be collected from the buyer which shall be retained with exchanges for a period of five months.

Shares held by the promoters and directors in these listed companies shall be allowed to be transferred by depositories only upon verification by concerned exchanges and they shall not be allowed to transact in the security except to buy securities in the said listed company until verification of credential/fundamental by exchanges is completed.

As for stock exchanes they will initiate a process of verifying the credentials/fundamentals of such companies.

Also exchanges will be appointing an independent auditor to conduct audit of such listed companies and if necessary, even conduct forensic audit of such companies to verify its credentials/fundamentals.

If exchanges do not find appropriate credentials/fundamentals about existence of the company, they can initiate proceedings of compulsory delisting againts the company and the said company shall not be permitted to deal in any security on exchange platform.

These companies holding in any depository account will be frozen till the delisting process is completed.

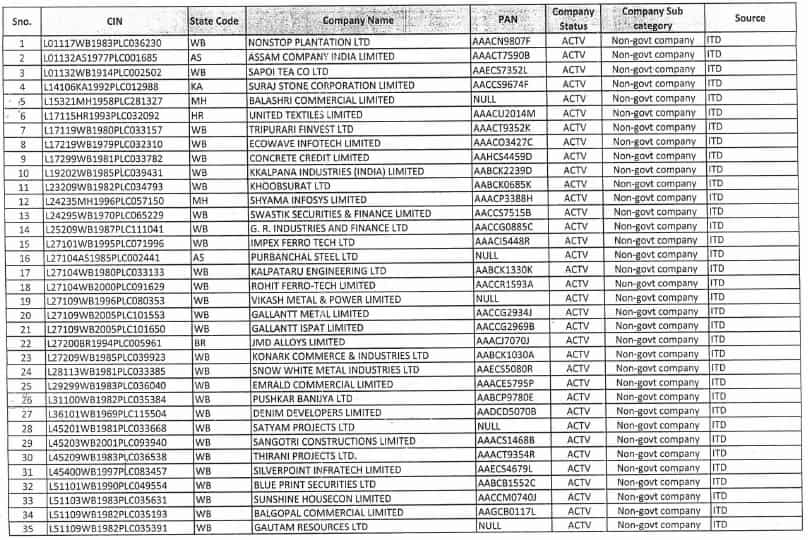

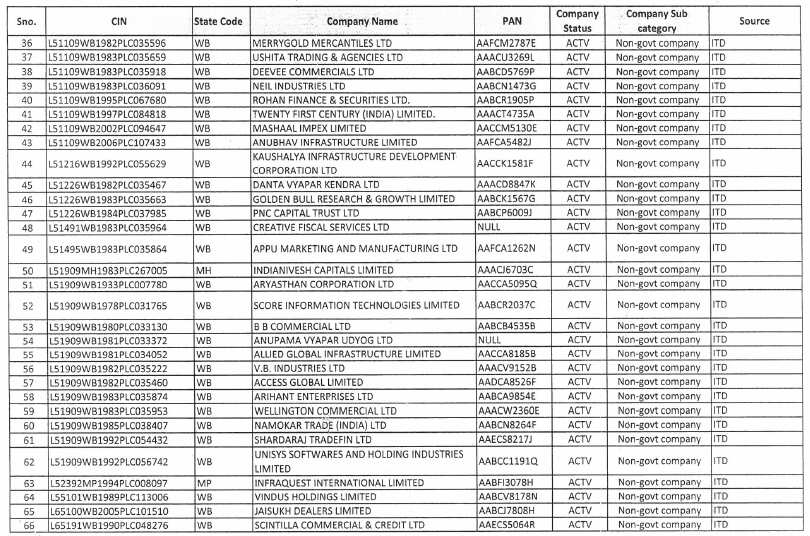

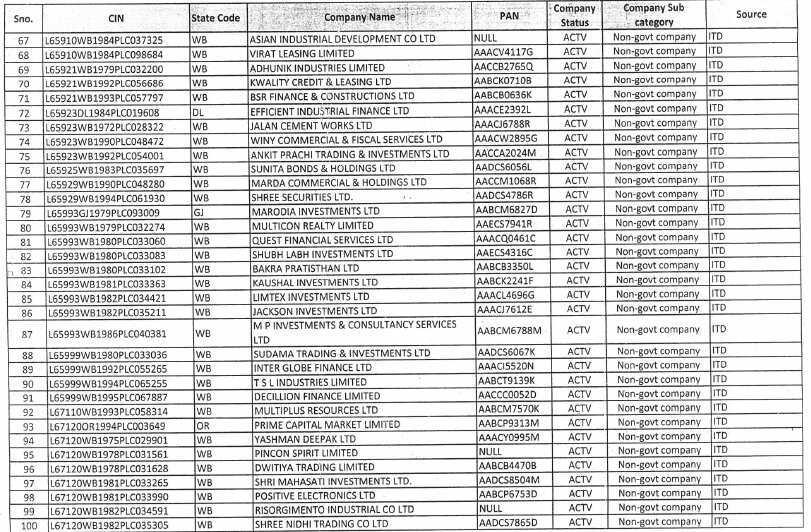

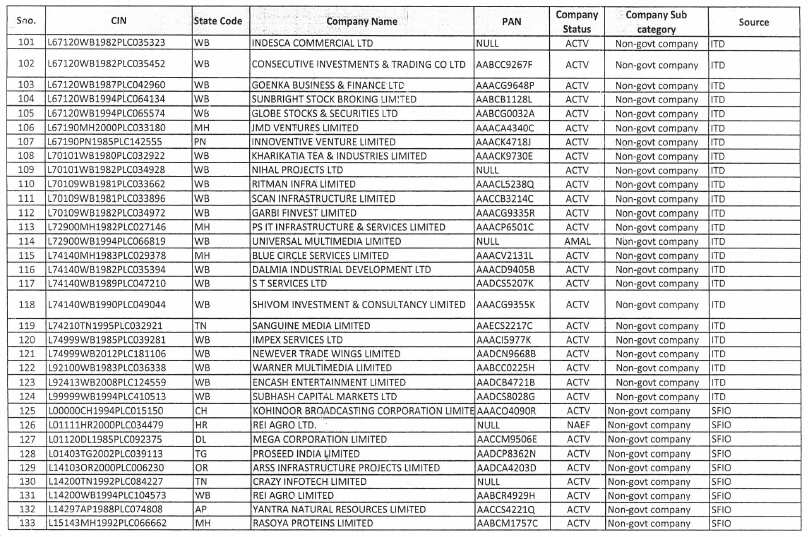

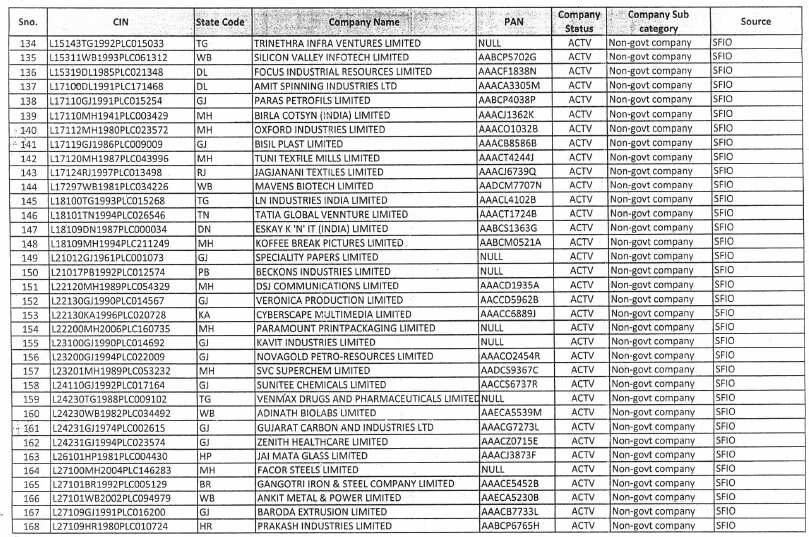

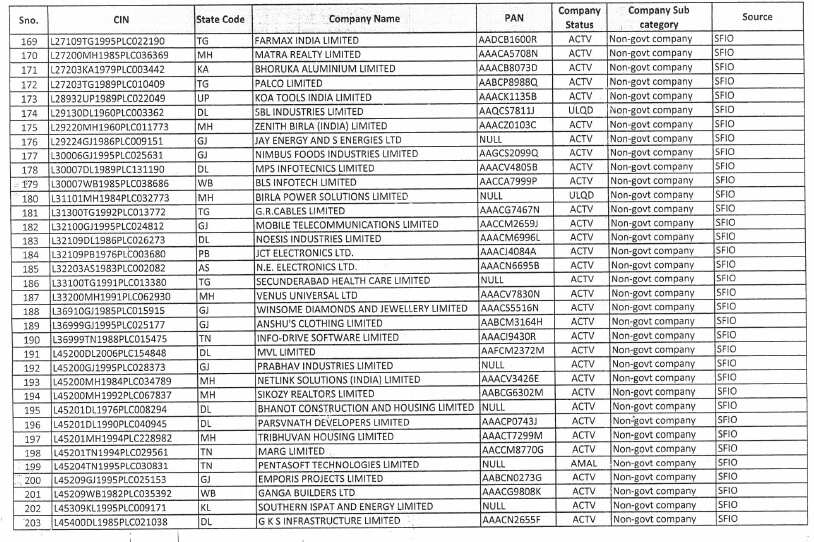

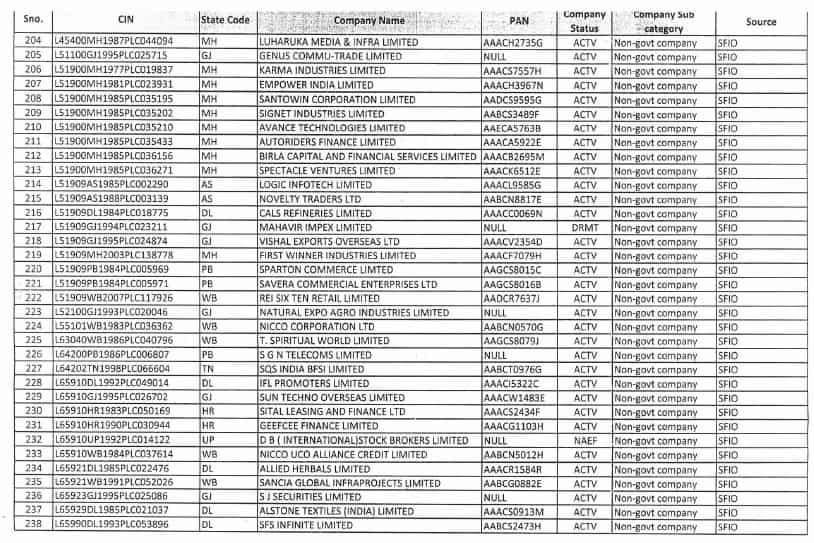

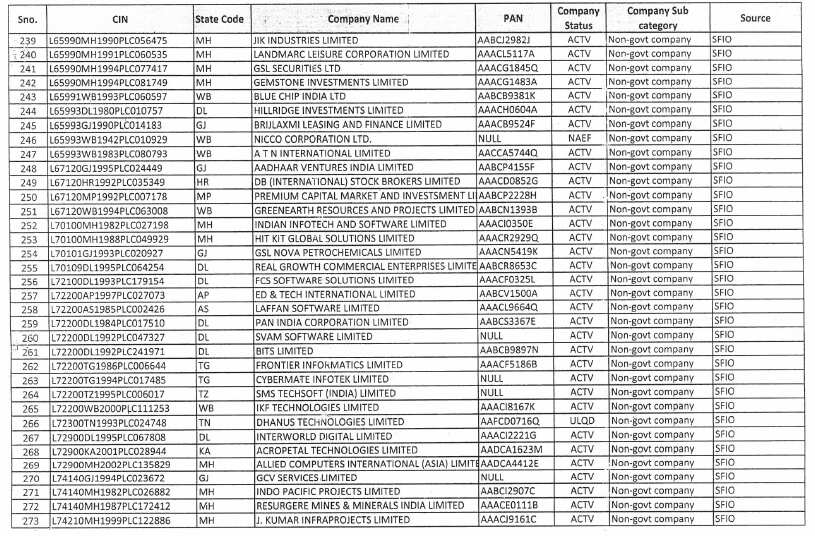

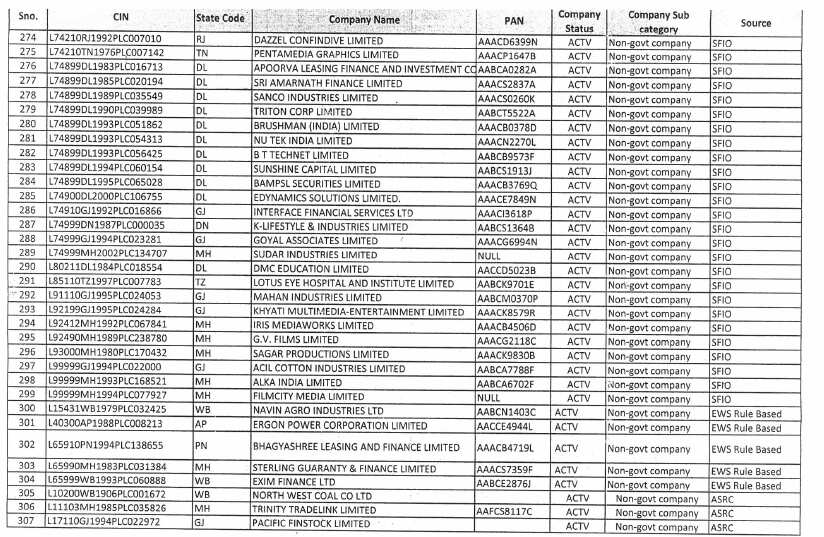

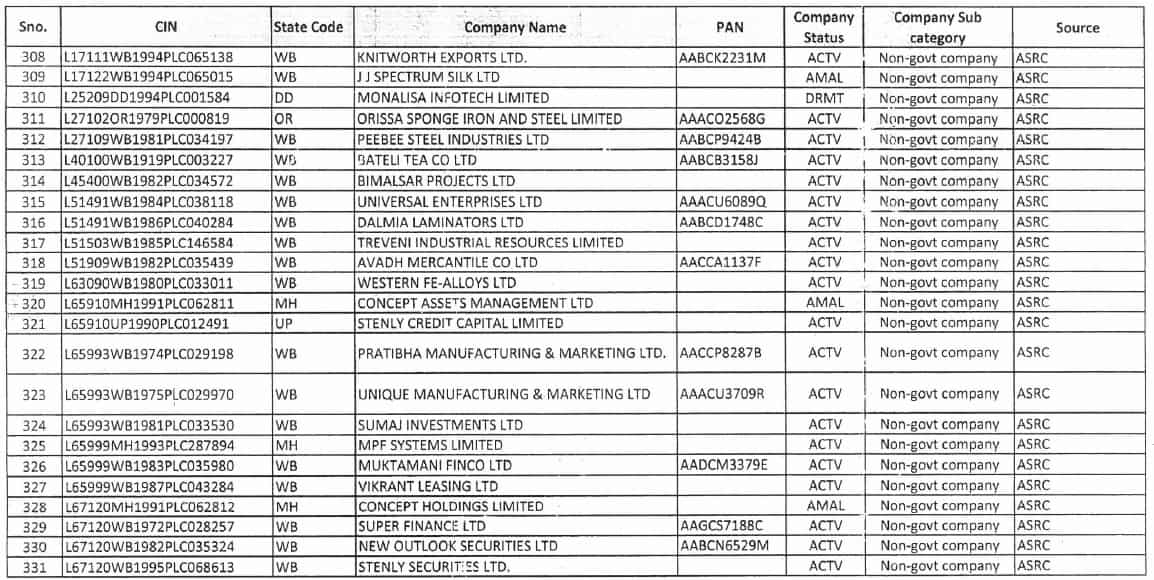

Here's a list of these 331 suspected shell companies, have you invested in any of these.

ALSO READ:

12:56 PM IST

SEBI comes forward to rescue security investors' interest

SEBI comes forward to rescue security investors' interest Stock Market: SEBI's F&O position limit affects several shares

Stock Market: SEBI's F&O position limit affects several shares Sebi allows non-bank custodians to manage gold, related instruments

Sebi allows non-bank custodians to manage gold, related instruments Want to work with SEBI? Applications invited - All you need to know

Want to work with SEBI? Applications invited - All you need to know Ajay Tyagi to get six-month extension as SEBI Chairman

Ajay Tyagi to get six-month extension as SEBI Chairman