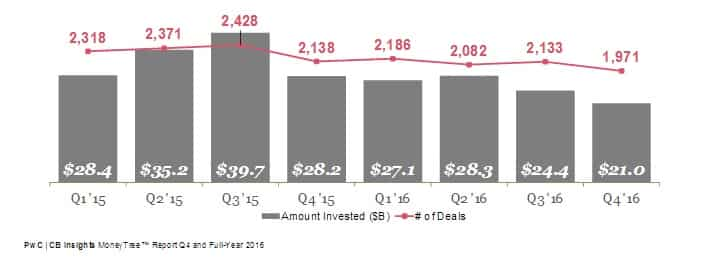

Funding to VC-backed start-ups declines by 23% globally in Q4 2016

The deal count for start-ups too dropped below 2,000 for the first time since Q4 2013.

Funding to start-ups by venture capitalists (VCs) globally has declined by 23% in terms of investment and 10% in terms of deals.

Deal count dropped below 2,000 for the first time since Q4 2013. In the whole of 2016, VC-backed companies received $100.8 billion across 8,372 deals, according to PwC-CB Insights MoneyTree Report.

Funding also fell for the second-straight quarter, seeing just $21 billion invested in Q4 2016. This represents an 89% drop since the 8-quarter peak in Q3 2015, which saw nearly $40 billion in funding, the report said.

Q4 2016 only saw a single deal above $1 billion, and 32 rounds above $100 million. There were 38 $100-million rounds the same quarter a year earlier.

In Asia too VC funding decreased in both deals and dollars in Q4 2016. It dropped to $5.5 billion in funding for the quarter, down 25% from $7.3 billion the quarter before. There were 337 deals into VC-backed Asian companies, the third quarter in a row below 400.

Every major start-up sector in Asia saw a slowdown in Q4 2016, with internet companies dropping the most by 43% in funding. Conversely, non-internet or mobile software jumped by 178%, fueled by a $120 million Series B funding to computer vision developer SenseTime.

“While Q3 2016 saw corporates participate in 43% of all deals in Asia, we saw a pullback and reversion to the norm with corporate participation reaching 34%. Early-stage deal size jumped from $2 million in every other quarter in 2016, to $3 million in Q4’16,” said the report.

North America received the highest funding of $12.2 billion from 1065 deals in Q4 2016, followed by Asia with $5.5 billion from 337 deals and Europe with $3 billion from 498 deals.

While North America received the highest VC-funding it had seen a drop below $13 billion for the first time since Q1 2014. While the US dropped in funding, Canada saw a jump of 49% between Q3 2016 and Q4 2016.

However, VC-funding for start-ups in Europe was the only one to beat the slowdown. In Q4’16, both deals and dollars went up in Europe. Funding jumped by 22%, hitting $3 billion of investment in the quarter. Deals increased for a third-consecutive quarter, hitting 498 deals.

05:17 PM IST

Enterprise Security start-ups most sought-after by VCs in 2016

Enterprise Security start-ups most sought-after by VCs in 2016 Microsoft, Qualcomm invests in Team8 a cybersecurity start-ups

Microsoft, Qualcomm invests in Team8 a cybersecurity start-ups  Electric car start-up Faraday Future unveils first production car

Electric car start-up Faraday Future unveils first production car More start-ups failed this year as 2016 saw funding drying up

More start-ups failed this year as 2016 saw funding drying up Paytm accounts for nearly 40% funding in fintech start-ups in last 3 years

Paytm accounts for nearly 40% funding in fintech start-ups in last 3 years